PROPERTY CONDITION MATTERS: Two Exclusive Equity Loan Programs for Windermere Clients Listing Their Homes

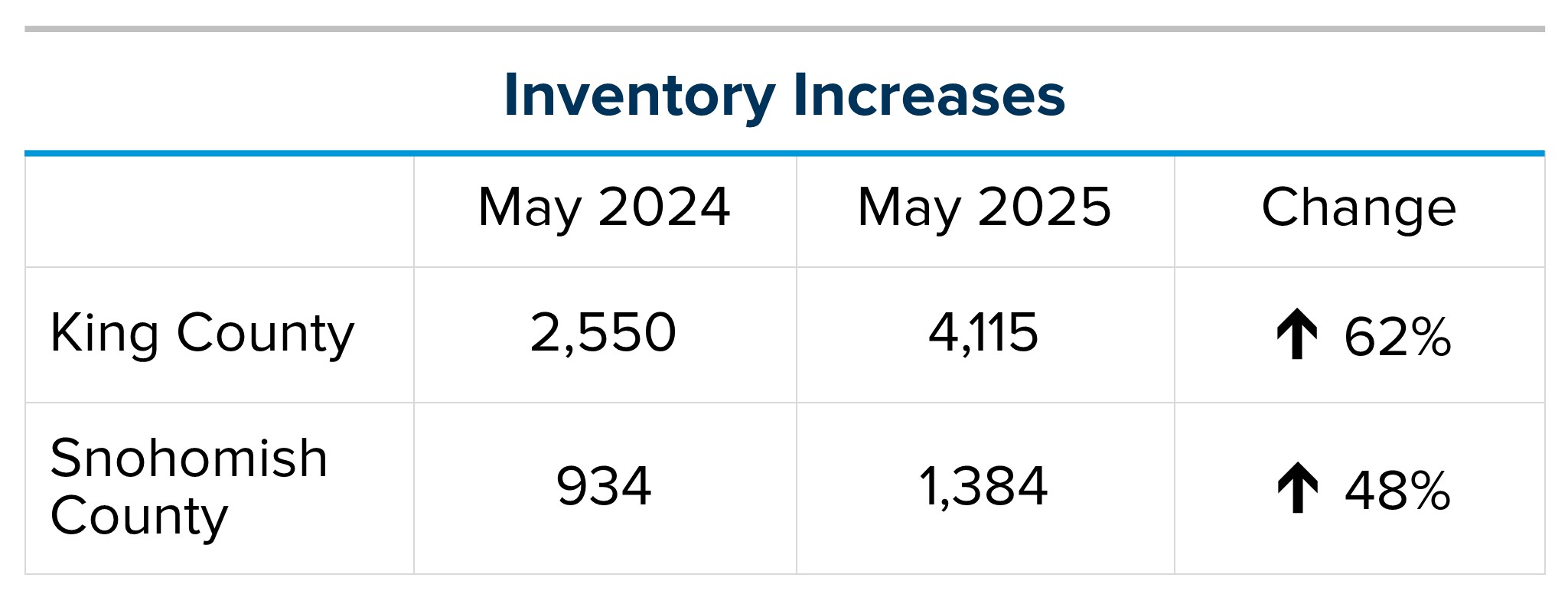

As market conditions shift and inventory increases, we are seeing that homes brought to market with sound property maintenance and thoughtful improvements are selling the fastest and yielding the highest returns. Inventory is up 62% year-over-year in King County and 48% in Snohomish County, highlighting the importance of standing out amongst the crowd. With interest rates remaining stubborn, monthly payments are buyers’ biggest concern, and many do not have the funds to make necessary repairs and improvements after a purchase. Eliminating property condition hurdles and even making modern improvements before listing the home is key to a seller’s success in getting their home sold!

Hurdles that we often encounter, which can adversely affect a home’s marketability, include deferred maintenance such as paint, carpet, and system improvements to HVAC, electrical, and plumbing systems. If a house needs a new roof or another central system replaced, this helps mitigate the upfront out-of-pocket expense. We have also seen sellers remodel and update areas of the house, such as the kitchen and bathrooms, to modernize and appeal to a broader audience. Exterior landscaping and junk hauling are also areas that help properly prepare a home for the market. A seller-procured pre-listing inspection often guides these improvements.

This is why Windermere offers two exclusive loan tools to provide sellers with access to funds based on their equity, helping them prepare their properties for today’s market. This approach is more efficient than wading through the red tape and longer timeframe associated with opening a Home Equity Line of Credit (HELOC). The Windermere Ready Loan Program now has two loan programs, Notable Loans and Move Forward Financial (MFF) Loans.

The Notable Loans range up to $50,000, and the MFF loans range from $50,001 to $100,000. Notable funds can be available to the homeowner as soon as the same day the application is processed (within minutes), and MFF loans are funded within 10 days of application approval. Approval for both loans is based on the homeowner’s credit score rating and the Windermere broker’s approval of the home’s market value to establish equity within the required loan-to-value ratios. There is no need for an appraisal; both programs provide home sellers quick and easy access to funds via a loan against their equity. Then they can get to work preparing their homes for sale to attract the largest possible buyer audience.

The home equity serves as the basis for these loans, so it does not require employment verification, making this an excellent option for retirees or sellers in a job transition. Over 50% of all homeowners in the US have equity of 50% or more, making this tool the perfect solution to help would-be home sellers prepare their homes for the market and appeal to as many buyers as possible. Plus, there are no up-front costs; the loan fee and accrued interest are paid off at closing. Please review this page for an outline of the key differences between the two exclusive Windermere loan programs.

So, how do these programs work? First things first, contact me, your Windermere broker, as these programs are exclusive to Windermere brokers and their clients. We can evaluate which areas of improvement will yield the greatest return based on market data and trends, establish a budget with bids from my trusted vendors, and devise a winning strategy.

In the meantime, if you want to learn more about how home improvements can help maintain and enhance a home’s value, check out the 2025 Remodeling Impact Report from NAR. This will provide valuable insight. As always, my goal is to help keep my clients up-to-date on the latest trends and empower them to make informed decisions.

My office just had our annual Community Service Day, where we worked with the Snohomish Garden Club, prepping, planting, and working hard to help make sure our local food banks will get thousands of pounds of fresh produce for our neighbors in need.

This is just a piece of the larger puzzle of Windermere’s commitment to community, and my office’s commitment to take on local projects.

Thank you for choosing Windermere and helping make all of this possible!

Change is Inevitable, Find the Opportunities in the Shift

The headlines are swirling about the real estate market. The environment is shifting from a seller’s market to a balanced market, creating opportunities for buyers and holding sellers to exacting standards. The primary factors affecting this shift are inventory levels, interest rates, and consumer confidence. These are the same factors that commonly influence the market conditions, and for the first time since 2018, months of inventory have reached their highest peak. Interest rates have remained stubborn, hovering around 7% for the last six months, and the stock market drama in April took a toll on consumer sentiment.

The good news is that the stock market has fully recovered from the April decline; however, the residual effects are likely to have some lasting impact on consumer confidence as they plan their financial decisions. Other good news for buyers is the increase in selection, which allows for more negotiations and can provide the option of a buyer credit. In King County, there were 62% more homes for sale in May compared to the same month last year, and 33% more than in April. In Snohomish County, there were 48% more homes for sale in May compared to the same month last year, and 32% more than in April. It is also important to note that each sub-market, established by price point, location, and property type, can vary. We are currently seeing a mix of sellers’, balanced, and buyers’ markets across the region as inventory increases.

We surveyed our office’s pending sales over the last two months, and one in three transactions had a buyer credit, with an average credit of $14,000. This is where a credit to the buyer from the seller is baked into the contract. Often, this accompanies a full-price offer (from the list price), and sometimes the offer is below the list price. These credits are used to offset the buyer’s closing costs, which leaves more money in the buyer’s pocket post-closing for improvements, a larger down payment, or savings. We are also seeing savvy buyers use these credits to buy down their interest rate, thereby saving on their monthly payment.

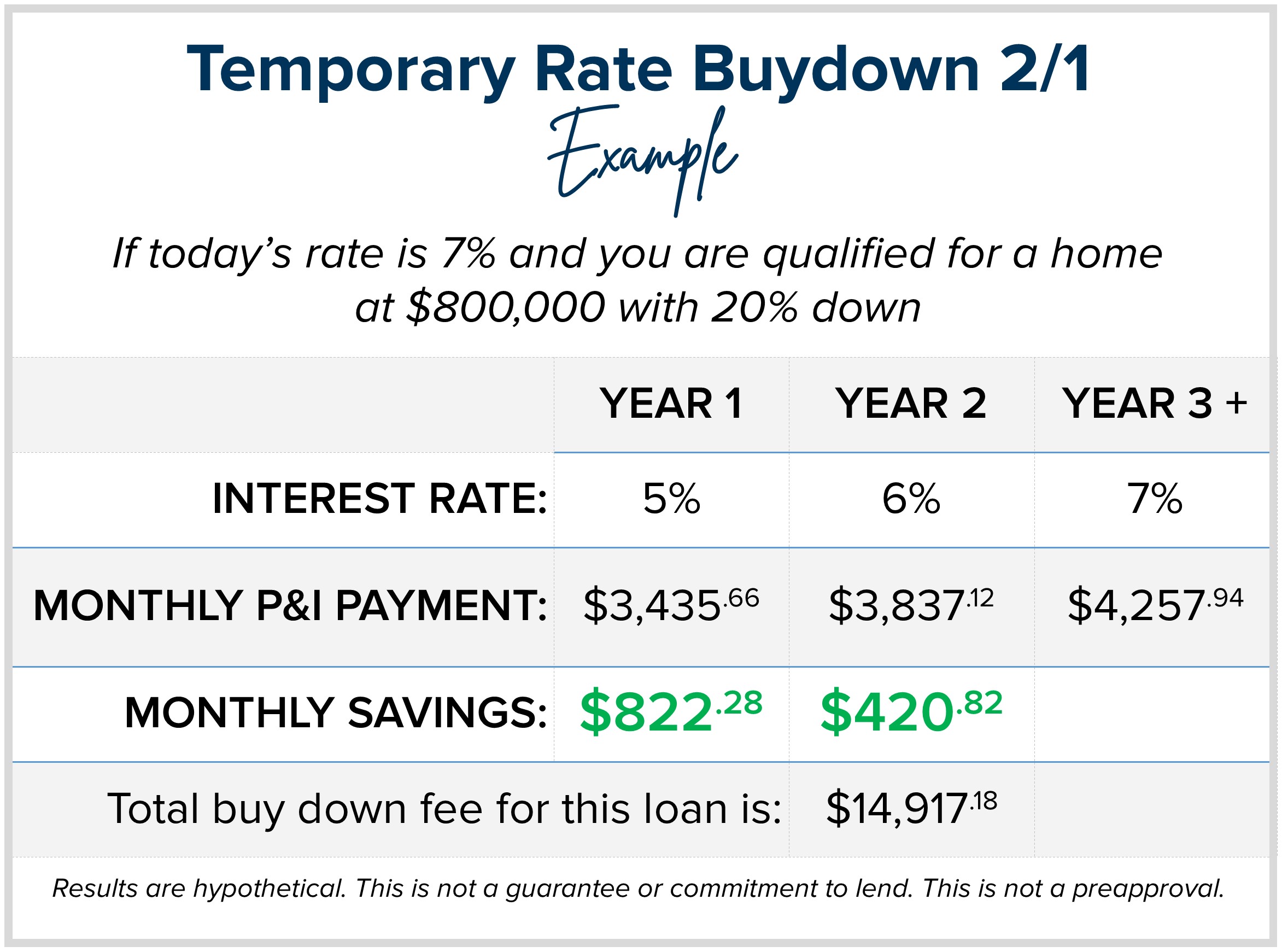

A permanent rate buydown requires approximately 3% of the purchase price to lower the rate by one point for the 30-year term of the loan. A good rule of thumb to remember is that every 1-point decrease in rate equals a 10% increase in buying power. For example, if the rate is 7% and you are qualified for a home at $800,000, and the rate were to decrease by 1 point to 6%, you could now afford $880,000 with a very similar payment. Another way to look at this is simply the monthly payment itself. An $800,000 purchase with 20% down and a 6% interest rate would save a buyer $420.82 a month compared to the payment at 7%.

A permanent buydown is a valuable tool, as is a temporary buydown. It is one of the most powerful tools in today’s market. It costs far less than a permanent buy-down. Here is an example: let’s say you are shopping for a house and have an $800,000 budget, along with a 20% down payment (btw, this works for any down payment amount), given today’s interest rate of 7%. The monthly principal and interest payment would be $4,257.94. You could do a 2-1 buydown (2 points lower in year one and 1 point lower in year 2), which would have your payment in year one be based on an interest rate of 5% with a monthly principal and interest payment of $3,435.66 – a savings of $822.28 a month. For year two, the monthly principal and interest would be based on 6%, resulting in a monthly payment of $3,837.12, a $420.82 savings. The total savings in monthly payments with the 2-1 buy-down over the two years would be $14,917.18.

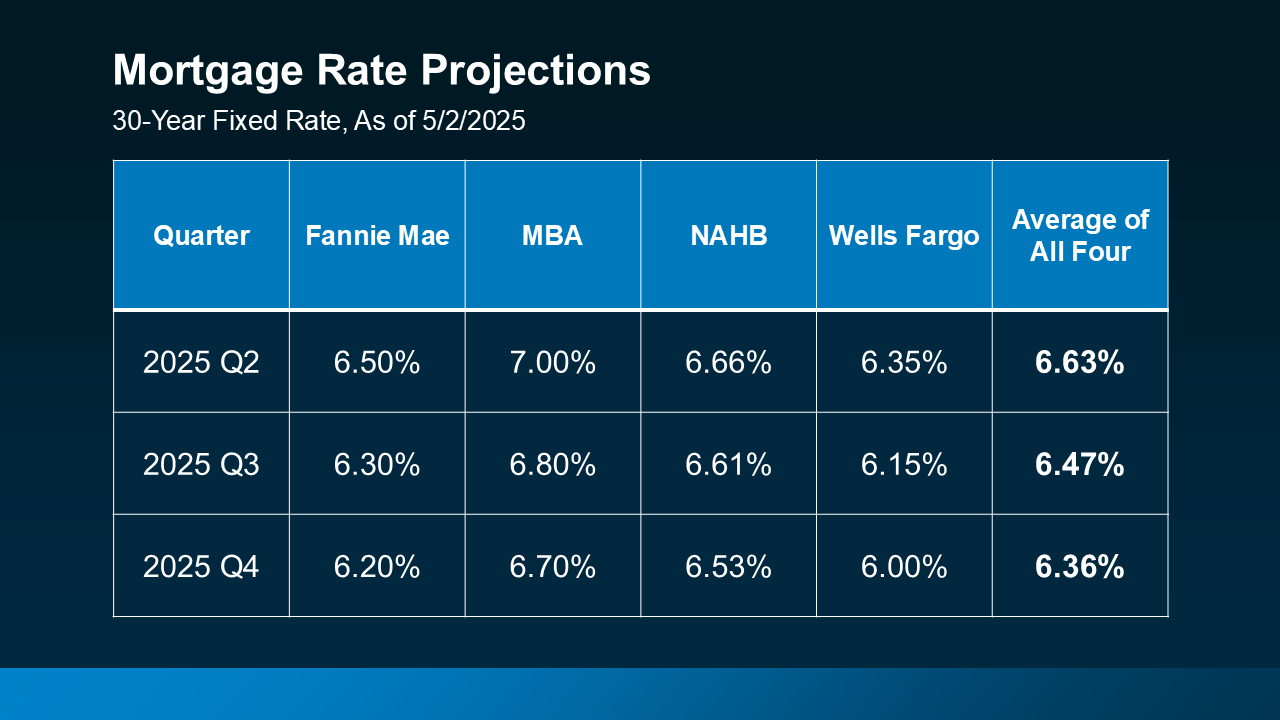

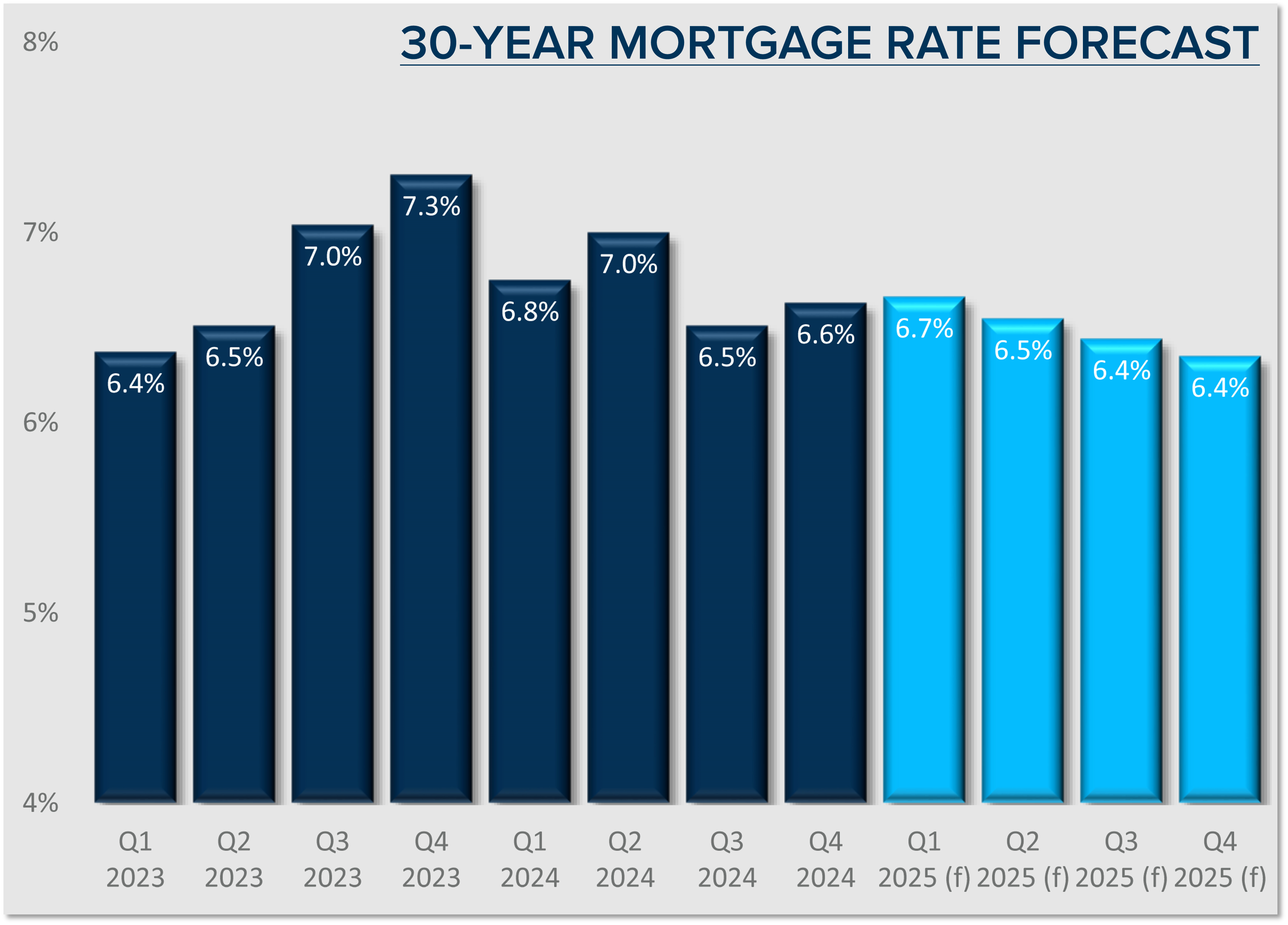

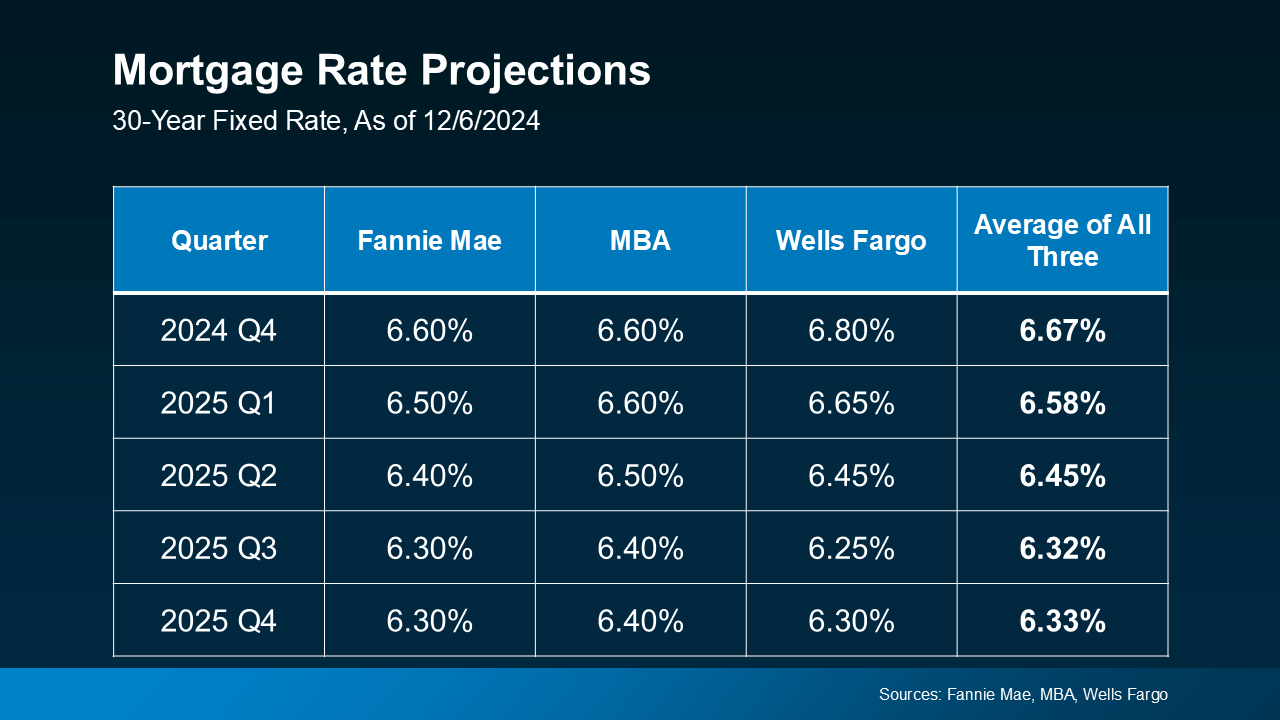

The roughly $15,000 in monthly payment savings is paid upfront at closing and can be provided as a buyer credit by the seller. The buyer still needs to qualify based on the 7% interest rate, as the payments will be converted to those based on the 7% rate in year three and moving forward. The buyer may never have to pay the 7% amount if rates decrease and they can refinance within the two years, permanently locking in a rate below 7%. A bonus is that if the entire $15,000 credit has not been used yet, in some cases, those unused funds can be applied towards the refinance. The latest expert rate predictions are below. While we don’t have a crystal ball to predict when this will happen, I do know that when it does, there will be more buyer competition in the market, which will affect negotiations.

A peculiar aspect of consumer sentiment is that when there is more inventory and the market becomes more balanced, as opposed to a tight market where buyers are competing for limited choices, it confuses buyers. They tend to slow down and think something may be wrong. Savvy buyers will zero in on a house they want and use this time to negotiate better terms for due diligence and possible credits, rather than escalating prices and accepting no contingencies that often occur in a seller’s market. Another benefit to a balanced market is the return of home sale contingencies. This balance of inventory is necessary to introduce this option, and it has been quite a while since we’ve seen this happen. Although they are not commonplace, they are on the rise. This enables the buyer to purchase contingent on the successful sale and closing of their current home. It was how real estate used to be done, and a great option if all lines up.

Now, how does this increase in inventory affect sellers? As mentioned above, it raises the bar on property preparation, accurate price positioning, and overall appeal. When there are more choices, you need to stand out! That is why homes that meet these criteria continue to sell for more than their list price and receive multiple offers. Homes that are brought to market, neutralized, staged, free of deferred maintenance, and appropriately priced are selling quickly. If a home has modern improvements, that helps too, as many buyers prefer move-in condition as they are often using the bulk of their savings for a down payment to create the lowest possible monthly payment.

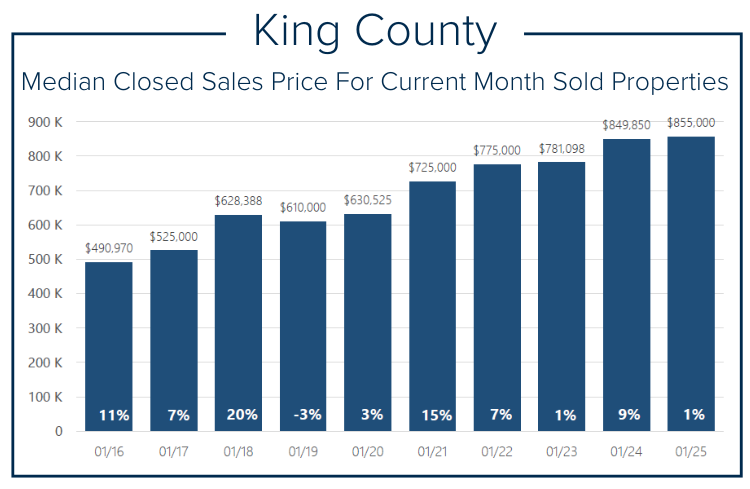

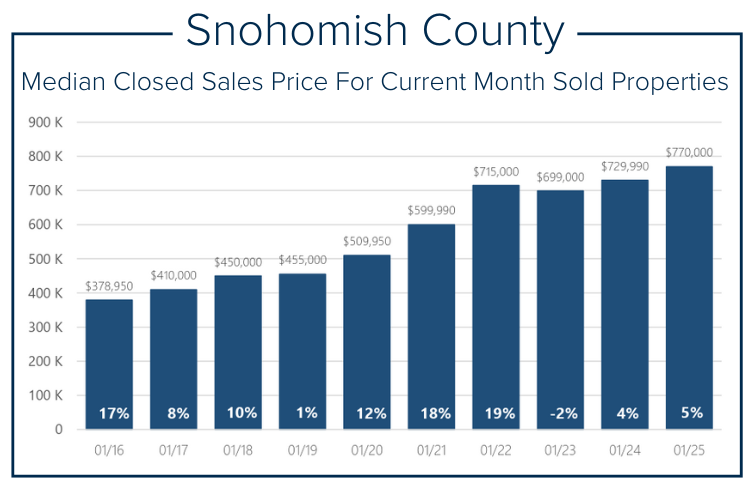

So, what is appropriate price positioning? I will start with the big picture first. Sellers must maintain a long-term perspective and assess their equity growth during their ownership. Single-family residential prices in King County have increased by 91% over the past decade and by 44% over the past five years. Single-family residential prices in Snohomish County have increased by 113% over the past decade and by 52% over the past five years. Sellers have made remarkable gains, and success should not be measured by the froth of a seller’s market, but by the gains of a sale in any market. The big-picture approach often leads to a smooth and profitable transition from one house to the next.

Now, back to the tactics of price positioning. Annual prices typically peak in the spring, and after reviewing the latest May 2025 figures, it appears we have hit the peak for the year. This is about 30-45 days earlier than in 2024 and previous years. Additionally, year-over-year prices are flat and slightly down from 2024, so sellers should consider this when choosing their price with their broker. This, along with the increase in selection, means that sellers need to determine the value point at which a buyer is willing to make an offer when they have more choices. They cannot price based on last year’s market, which had different environmental factors.

One thing we can always count on in life is change. The real estate market is no different. In the case of our local real estate market, this change sits on the shoulders of monumental growth. There is always an opportunity within the change, and staying close to the data helps unearth this. I’m encouraged by the balance in the market and look forward to helping my clients navigate their life transitions in the most effective way possible. Research, data, and listening to my client’s goals are the backbone of my approach. If you or someone you know is experiencing significant life changes that a move could help with, please reach out. We can discuss the big picture, apply the data, and chart a custom plan together. It is always my goal to help keep my clients well-informed and empower them to make strong decisions.

Need to Know: Top Takeaways from our Homeowners Insurance Panel

Last week, my office hosted a panel discussion on the hot topic of homeowners insurance. In the wake of several natural disasters, supply chain issues, and inflation on building materials, homeowners insurance is currently experiencing a “hard market”. Non-renewal and cancellation rates are rising, some carriers are leaving certain states, and specific aspects of a home, like wood-shake roofs, are being more scrutinized. This has caused coverage to increase in cost and, in some cases, not be available. We assembled this panel to get this critical real-time information in front of our clients, so they can adequately care for their home(s).

As your trusted real estate advisor who helps you transact when it is time for a move, I also see it as my role to help you protect your asset through education. While I am not an insurance expert, the esteemed panel of insurance professionals we invited to discuss the state of the homeowners insurance market is an example of a trusted advisor in the homeowners insurance field. Below are my top takeaways from the hour-long guided discussion. You can also access the event recording below, which also includes 30 minutes of Q&A from the audience.

What is RCV (Replacement Cost Value), and why is it important?

RCV is the dollar amount established to determine the cost of rebuilding your home to its pre-damage condition. This is different from market value, which includes the land and location premiums. RCV estimates the cost of materials and labor to restore or rebuild your home at today’s prices. This number is critical, and that is why it is important to always let your carrier know when you have made changes or improvements to your home. NOTE: Some carriers use ACV (Actual Cost Value), but this is not preferred as it takes into account depreciation.

Request an annual review of your policy with your carrier.

Most carriers have some built-in annual coverage adjustments, but they are often insufficient. The homeowner is responsible for reporting upgrades, additions, and improvements to their carrier so the increase in investment translates to coverage. Record-keeping of invoices and receipts helps establish accurate replacement value. Notifying your carrier of these changes will capture the appropriate coverage.

Request and review the Declaration Page in your policy.

The declaration page in your policy provides a detailed overview of your coverage. It lists what is covered, the RCV, notes additional riders, and outlines your premiums and deductibles. This is a valuable tool for helping you understand your policy and ensure that everything you have done to your home is included. You can easily request this from your carrier, and it should lead the discussion at your annual review.

Coverage vs. cost matters!

Carriers often advertise and try to appeal to customers based on the affordability of their rates. While no one wants to overpay for insurance, you must analyze the cost-benefit of adequate and complete coverage over the cheapest policy. Oftentimes, the cheapest premiums will lead to your home being underinsured.

Consider adding specific riders for additional coverage.

Unfortunately, earthquake and water backup riders are not included in your basic policy. However, you can purchase these specific riders to add them to your policy and be covered should damage be caused by an earthquake or your sewer line backing up into your home and causing a flood. Adding riders for personal property, such as fine jewelry, is common. These will be listed on your declaration page for an easy accounting of your coverage. Make sure you ask your insurance professional what other rider options are available, so you don’t miss something you would like covered.

Align your deductible with your claim tolerance.

You want to analyze at what point you would make a claim if something happened to your home. The theory of only making a claim if the repair or replacement amount is catastrophic is a good rule of thumb to ensure your policy is not dropped, non-renewed, or wildly increased in premium. What is catastrophic for one person may not be for another, so it is a personal preference around your financial comfort. What you don’t want to have happen is to make a claim on something you could handle on your own, and then have something big happen and no longer be covered. Always consult your insurance professional off-the-record before contacting the carrier directly, so your decision-making is not misconstrued as a claims risk.

Maintain your home to protect your premium.

Due to the industry’s tight margins, many carriers are visiting properties and performing drive-by and/or drone inspections to help determine their risk exposure. They are also accessing Google Earth to make these determinations. Homes that do not appear well-maintained are penalized with premium increases and sometimes dropped by their carriers. This is also why opening and reading all mail from your insurance carrier is essential.

The home and the human are considered in the coverage.

The home’s condition will play into the coverage and premiums, as will the human who is purchasing the policy. Carriers will examine a person’s claims history to help determine their risk exposure. It is common to look back 36 months, and if a person has multiple claims in that timeframe, they will have higher premiums and, in some cases, not be able to purchase coverage.

Have a good relationship with your insurance professional.

Whether working with an insurance broker or a captive company, having a consistent relationship with your provider is valuable. They should be available to answer questions, help you decide whether to make a claim, and review your policy and riders annually. You should never call the carrier directly without first contacting your insurance professional. They can help you navigate important decisions that will keep your coverage intact and your premiums manageable.

I hope you found this information useful—I know I did! It drove home my responsibility of managing my policy and ensuring I am adequately insured through communication with my insurance professional. Much like real estate, having a trusted advisor regarding homeowners insurance is crucial. After all, our home is often our largest asset and most prized possession. Protecting it is critical! Click HERE to access the recording (Passcode: E+gmk9V*) to watch the panel discussion.

As always, please don’t hesitate to reach out if you have any questions or concerns about your property, and I can help guide you to the right answers. I have reputable referrals to multiple insurance professionals that can help you should you need additional contacts. My goal is always to help keep my clients informed and empower them to make strong decisions.

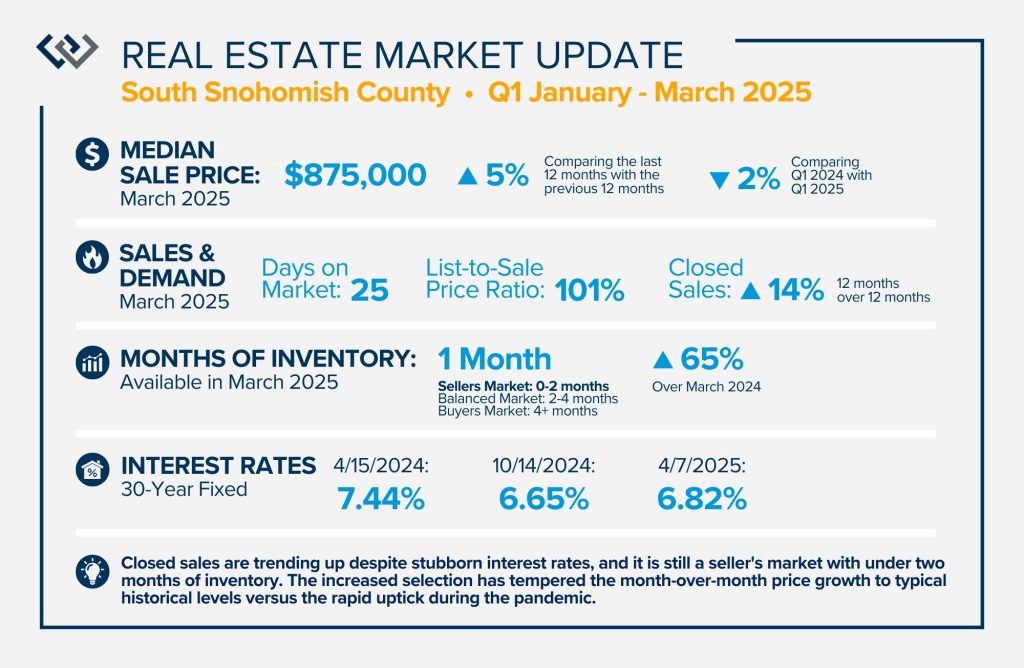

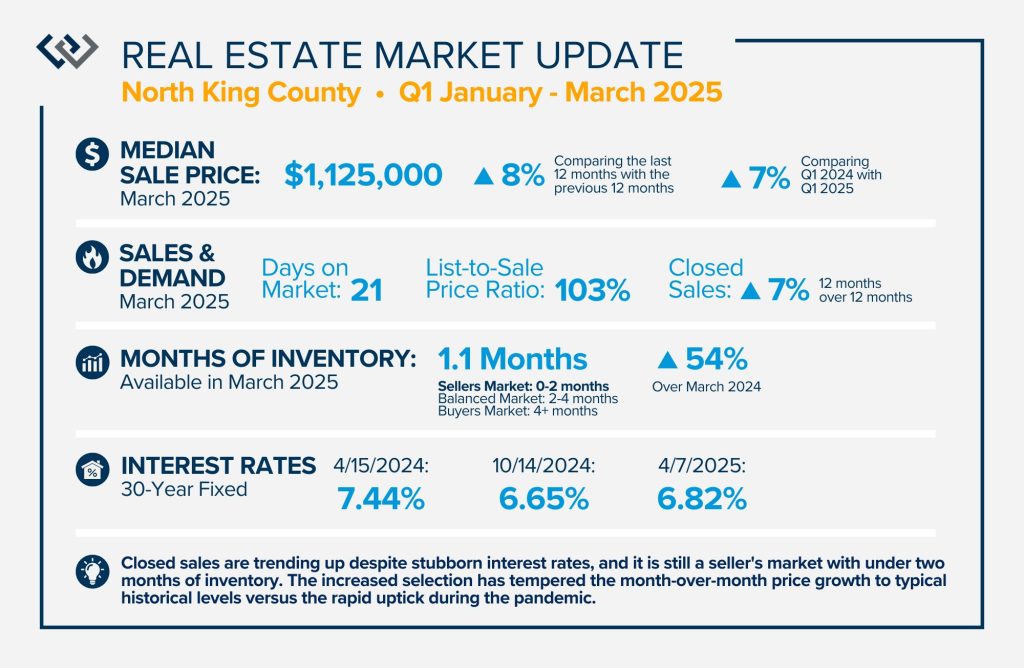

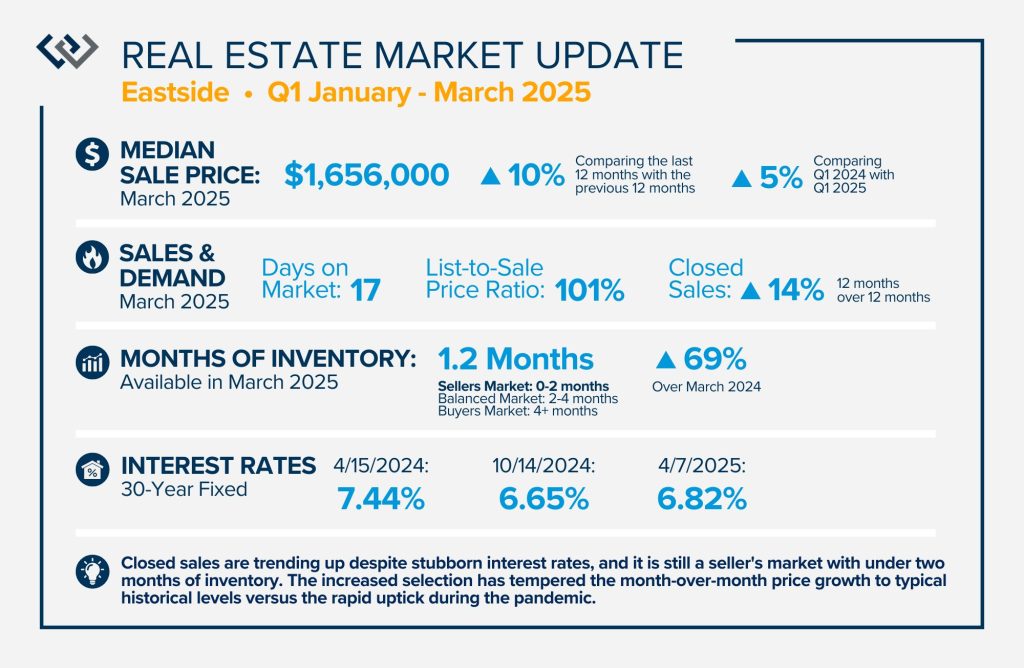

QUARTERLY REPORTS Q1 2025

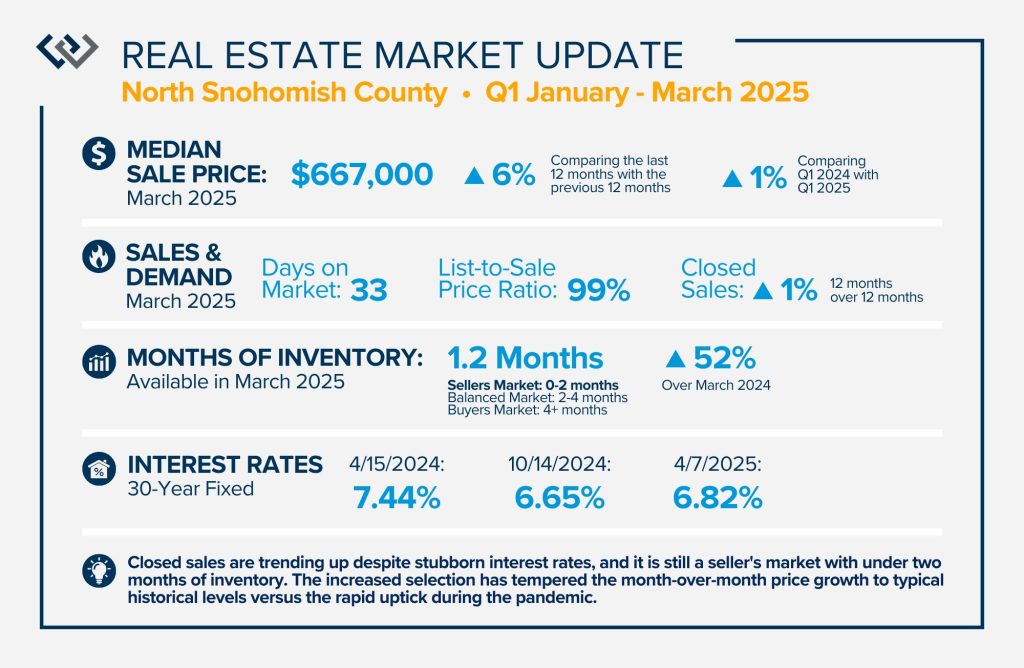

Year-to-date 2025, there have been more new listings than in 2024. After two years of tightly constricted inventory, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

Delayed seller demand is starting to mount as some people are giving up their low rate to pivot to a home that better fits their lifestyle. With this increase, we anticipate more sustainable and stable price growth, which will rest on the shoulders of strong equity levels built over the last decade plus. Evaluating and applying the trends to your options will help you make informed and powerful decisions. Please don’t hesitate to reach out if you or someone you know would like to learn more, discuss goals, and create a winning plan.

Market Snapshot: A Quick Look at Preliminary Q1 Stats

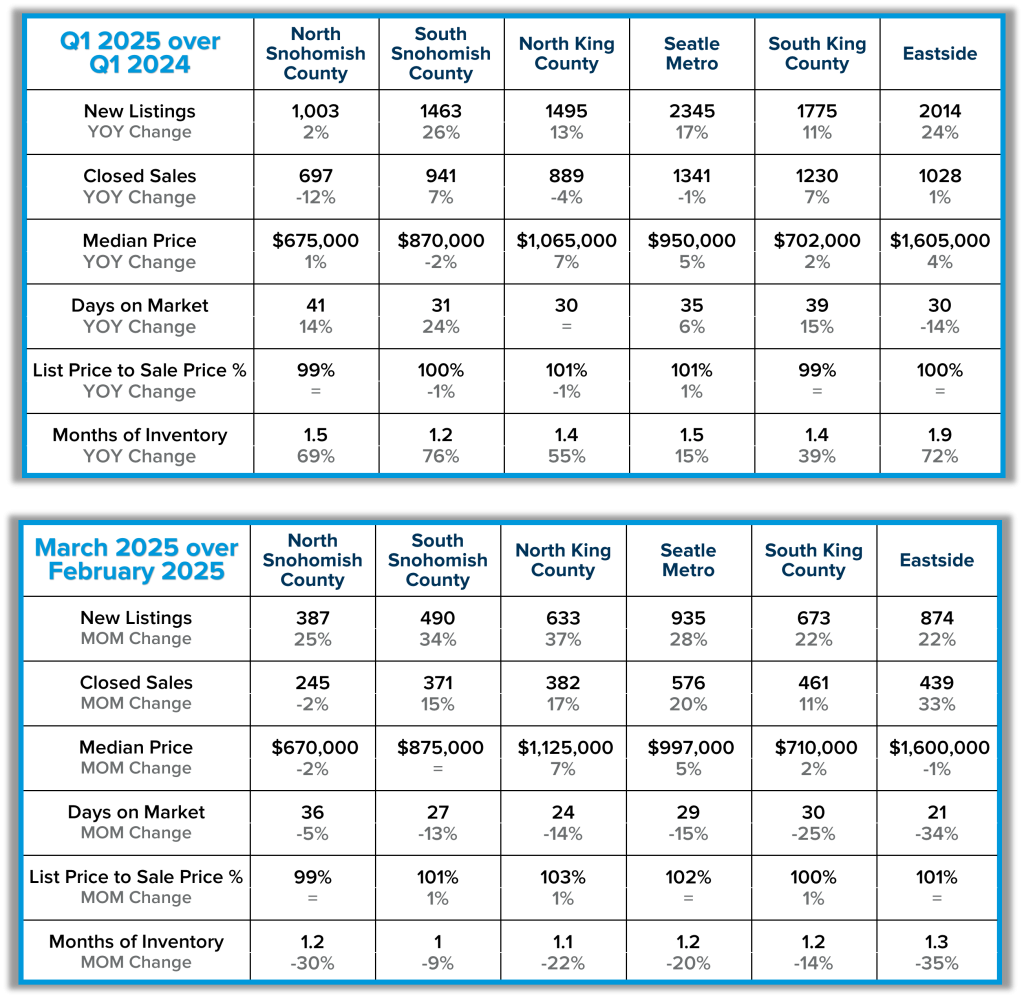

As we head into Q2, I wanted to review preliminary Q1 stats in order to report the latest trends in the market. The spring market has sprung, and activity is positive on both the seller and buyer side. The two charts above show key market factors from two points of view, March 2025 over February 2025 (Month over Month, MOM) and Q1 2025 over Q1 2024 (Year over Year, YOY). By looking at MOM, you can see the real-time progression of activity as we head into the busiest time of year in the real estate market, and the YOY look compares how 2025 is starting in comparison to 2024.

MOM new listings made a big jump up, days on market are shrinking, list-to-sale price ratios are slightly rising, and prices are maintaining and appreciating. Inventory remains tight despite the increase in new listings, with all six market areas sitting at a Seller’s Market (0-2 months of inventory). This indicates strong buyer demand that is absorbing the selection despite the slow decline in interest rates. We anticipate a strong spring market with more opportunity than 2024 provided for buyers, which is a welcome change.

The second chart shows that in Q1 2024, inventory was much more constricted in comparison to Q1 2025. The limited inventory last year created intense upward pressure on prices when rates were even higher than they are now. We are maintaining home values and growing at a slower pace than last year, which will be more sustainable. With affordability at an all-time low, this is good news for buyers. Sellers are still making incredible gains as price growth has been phenomenal over the last decade, and YOY, it is looking positive. With real estate being a long-term hold investment, many sellers are enjoying favorable returns when they decide to make a move.

Overall, the start to 2025 is taking on typical seasonal patterns. We have seen a quarter-point dip in interest rates, more selection, continued buyer demand, and sizable seller equity. If you are curious about how the trends relate to your real estate goals, please reach out. It is always my goal to help keep my clients informed so they are empowered to make informed decisions.

At press time, these figures accounted for the majority of March closings outside of the last two days. They still tell the story of the trends, so I was anxious to get them out. If you are on my physical mailing list, you will receive finalized numbers later in the month for your specific market area. Please let me know if you’d like to receive consistent quarterly reports, and I will add you to my snail-mail database.

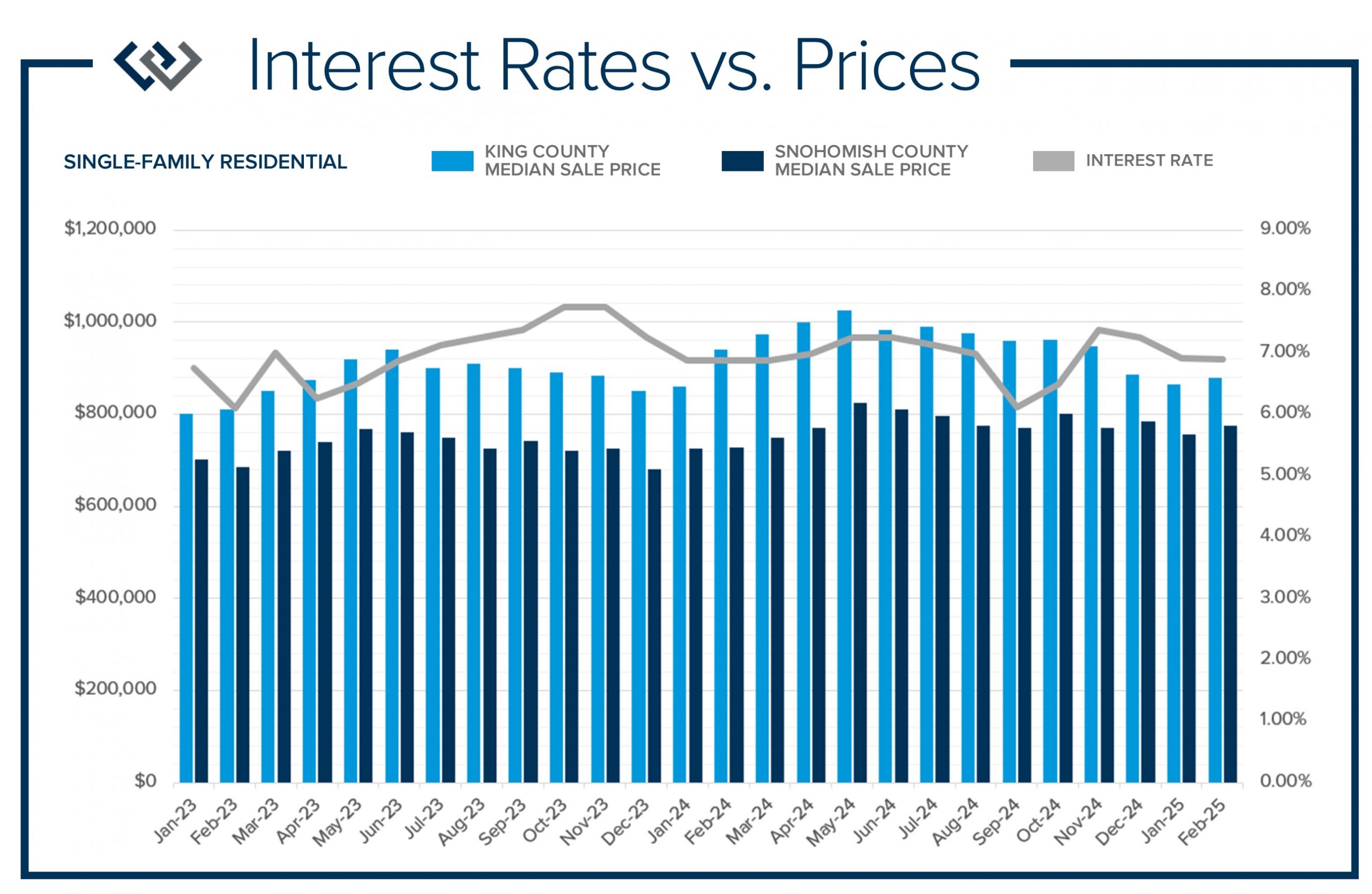

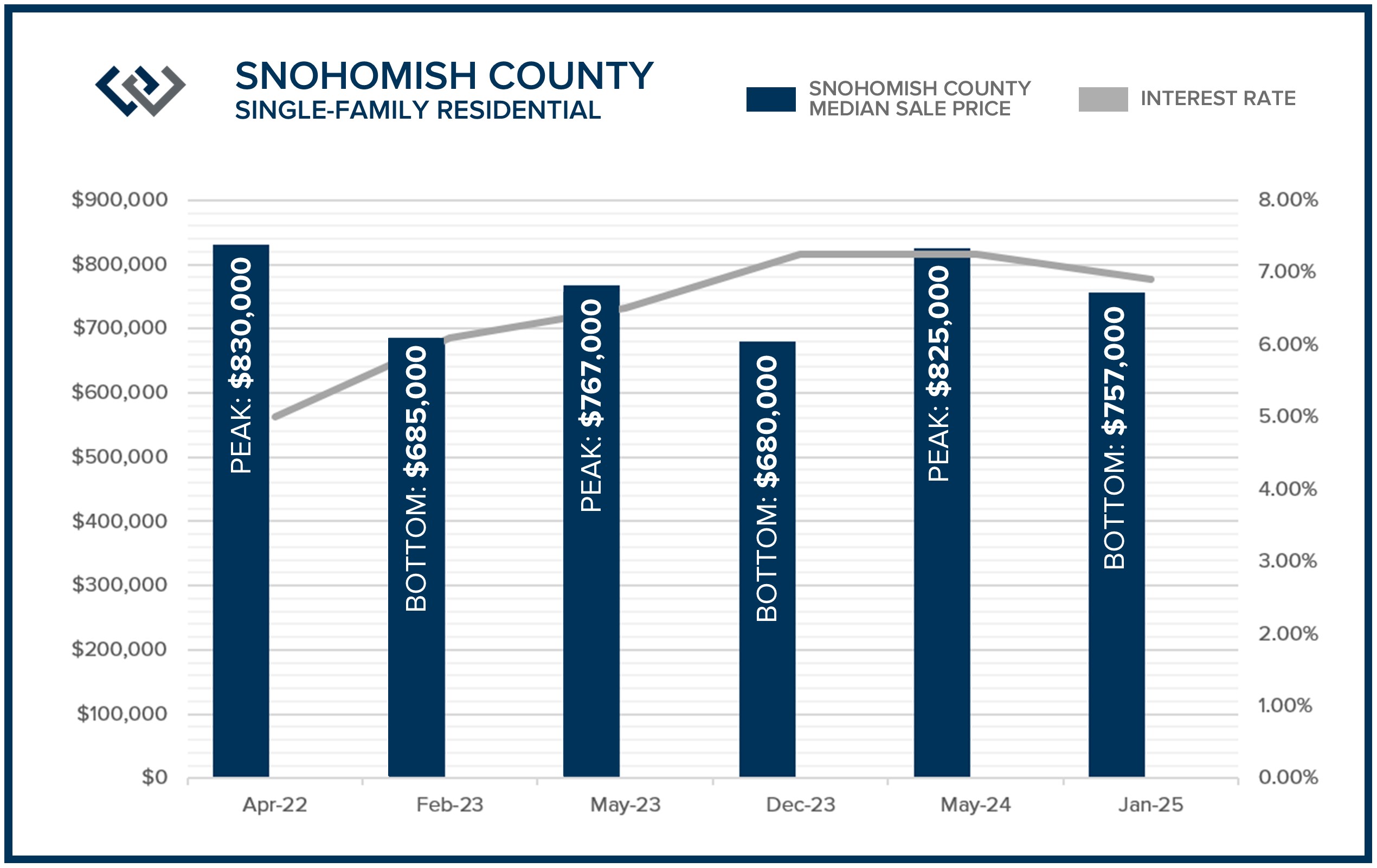

Home Price Patterns: The New Normal of Rates & Equity Growth

As we start a new year, I am often asked where home prices are headed. While I don’t have a crystal ball, I study the market trends and activity closely. Many aspects affect home prices, such as the overall economy’s health, inventory levels (supply & demand), and interest rates. Seasonality is also a pattern I pay close attention to, and we are headed into the time of year when we see most of the annual price growth happen. As we prepare for the Spring market, I have pulled some data that shows the seasonal patterns and the impact interest rates have had on prices, and long-term equity growth.

First, before we look forward, we must look back to understand the relationship between rates and prices. We went on a long run of rates being below 5% from 2010 to mid-2022, outside of the second half of 2018. Price growth was consistent after the recovery from the Great Recession in 2012 to 2018 and, in some cases, incredibly rapid. When the increase in interest rates happened in 2018, along with the proposed Seattle Head Tax, we saw a correction in home prices. It took the market about 15 months to recover from that correction.

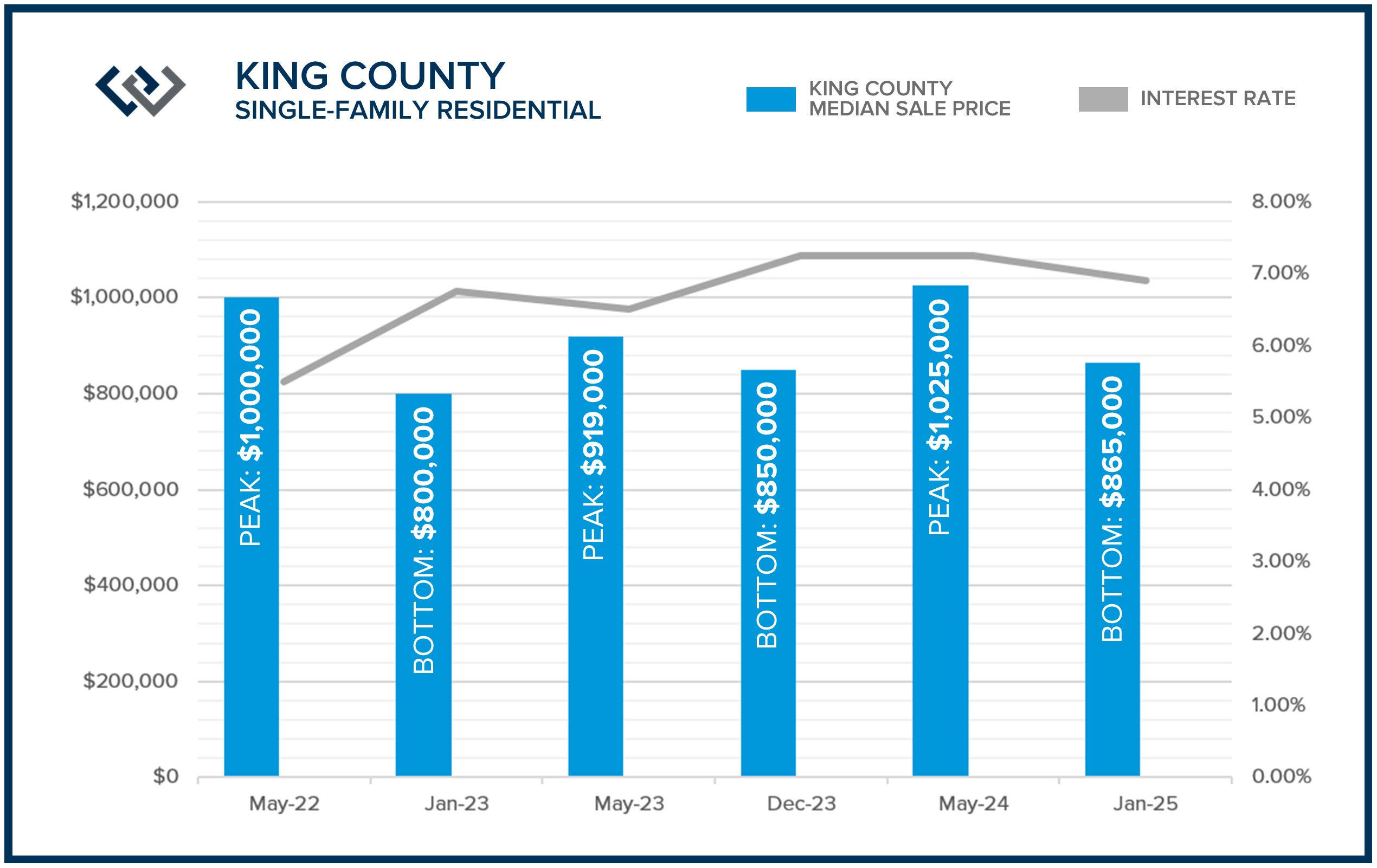

Then, we hit the pandemic-fueled market of 2020-2022, where price growth was off the charts. During that time, work-from-home moves flooded the suburbs and rural markets, early retirements and relocations to other states created movement, and interest rates under 3% drove prices up by double digits. At the beginning of 2022, rates started to creep up to counter inflation and increased by 2 points in four months, landing at 5.5% in May 2022. This, like 2018, forced a correction in prices. This correction took 24 months to recover, with prices regaining their May 2022 peak in May 2024.

This recovery all happened amidst interest rates peaking at 7.91% in Oct 2023 and never going under 6% the entire time. Rates have hovered from 6.75%-7.25% over the last year, outside of a small window in the Fall when they were in the mid-6%. This illustrates that the market has become accustomed to the new normal of interest rates, and prices have been strong and stable. Tight inventory has helped bolster price stability and growth with limited supply to fuel demand.

If you look at the recovery from May 2022 to May 2024, you must also understand the seasonality of the market. This pattern has rung true for decades and has much to do with inventory levels. We typically start the new year with the lowest amount of available homes for sale due to the holiday slow down, short, dark days, and many families timing their moves around the school year. Once the new year starts, would-be buyers hit the market with their housing goals blowing wind into their sails.

This new demand is coupled with tight inventory, and the price growth for the year starts to take shape via price escalations via multiple offers. This becomes commonplace in Q1, and we begin to see inventory catch up in Q2 when the days are longer, the flowers are in bloom, and we are a little closer to the opening of summer break for schools, creating a less disruptive move. Despite the correction in 2022 and rates stubbornly remaining in the 6-7% range, sellers have realized incredible gains, and buyers who have made purchases have secured their trajectory of building wealth through owning real estate.

Even though price growth is more accelerated in the first half of the year, the deceleration of price growth sits on the shoulders of the gains in Q1 & 2, ultimately leaving prices higher year-over-year. This is a pattern we have seen for some time, and we are already starting to see it unfold in 2025. Month-to-date prices are up in February 2025 over January 2025 by 5% in King County and 1% in Snohomish County. This pattern can guide one’s timing of the market, and so can life. As much as hitting the perfect week when there is less competition and rates drop may feel like hitting your bet at the roulette table, making a move is much more nuanced than that. The timing of a move needs to work with the demands of life, and the good news is the year-over-year gains are positive regardless.

As we head into the spring market for 2025, we anticipate additional price growth from where we are now and following the trend of prices peaking in late Spring. We should regain and most likely eclipse the peak prices we saw in 2024. To expand this to the bigger picture, let me share some fun facts about long-term price growth and homeowner equity with you. This is especially important as real estate is a long-term investment, the four walls where you create your life, and not meant to be a lucky bet on black.

Check out the charts below that show how far prices have come over the last ten years! In King County, the January median price is up 74% since 2016 and up 36% since 2020. In Snohomish County, the January median price is up 103% since 2016 and up 51% since 2020. Equity levels are high across our region, with over 50% of homeowners having 50% equity or more. Many homeowners are in the fortunate position to reposition their equity into a home that is a better fit for their lifestyle if they are experiencing life changes such as a change in family size, job change, or a financial shift.

I hope this look back to look forward instills confidence in our real estate market and home values. If a move is in your future, you will prosper well. Please reach out if you or someone you know is considering a move, whether it is a purchase, sale, or both. I can help apply these facts and figures to your specific market area and help chart a plan according to the market conditions and your goals. It is always my goal to help educate my clients and empower them with the information to make well-informed, strong decisions.

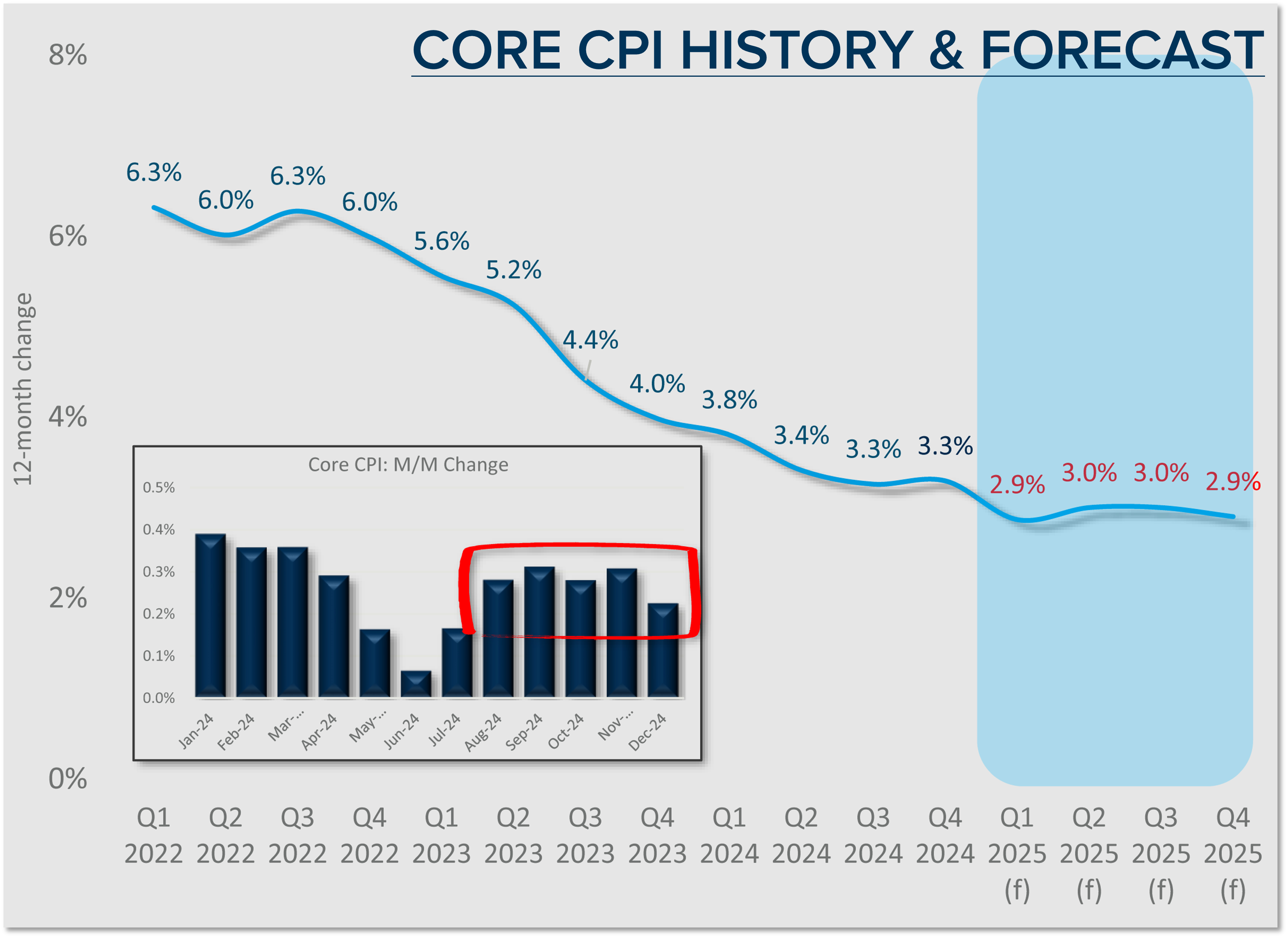

Top Takeaways from Matthew Gardner’s 2025 Economic Forecast

On January 22, my office hosted renowned economist and housing market specialist Matthew Gardner, who shared his 2025 Economic & Housing Market Forecast. We spent an hour listening to his keen analysis and insights, which included a look back at 2024, some discussion about what to expect with the new administration, and a look ahead to 2025 and beyond. Please let me know if you want to receive a link to the recording or a PDF of his PowerPoint slide deck.

He expertly broke down his presentation using a macro-to-micro approach, starting with the national economy and then narrowing down locally by presenting stats, figures, and predictions about the King and Snohomish County economies and housing markets. Here are my top takeaways.

✅ NATIONAL ECONOMY:

Inflation has become “sticky”! It slowly trended down in 2024 but could tread water in 2025, depending on what happens with tariffs under the new administration. If tariffs are instituted across the board, many countries are predicted to respond by implementing their own tariffs, which would increase the cost of goods.

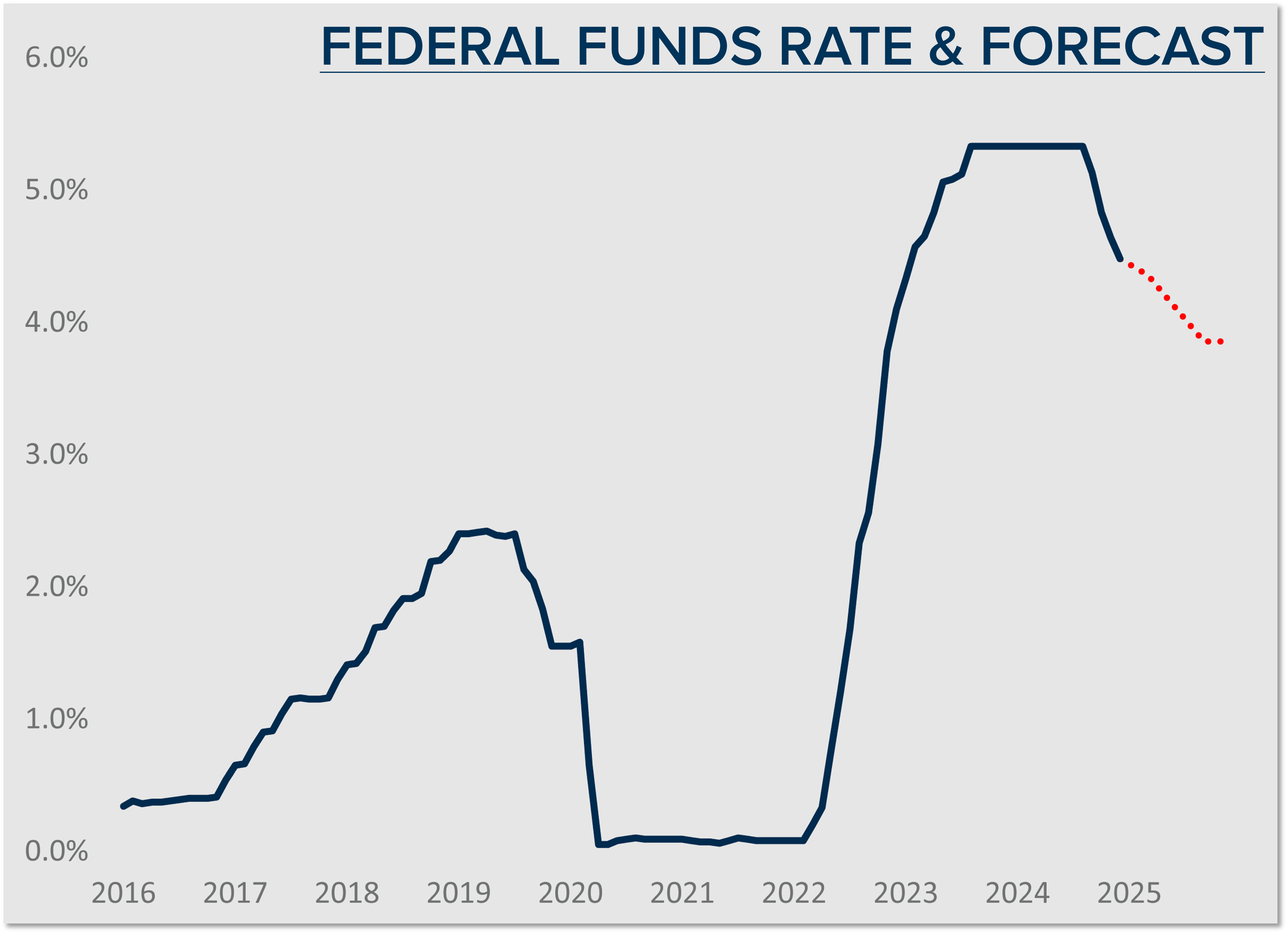

The Federal Funds Rate will slowly decrease over the course of 2025. Until we get clarity on proposed tariffs on U.S. trade partners, the Federal Reserve will remain aggressive with rates to combat inflation. The current consensus is for the Fed to make two rate cuts instead of four, with the first possibly being in February. NOTE: The Federal Funds Rate is the short-term interest rate (credit cards, car loans, etc.), not Mortgage Rates.

There is no sign of a recession. The balance of inflation, rates, and the overall health of the economy has created a soft landing that avoided a recession. In fact, GDP is up by 2% and the textbook definition of a recession is when the GDP decreases over two successive quarters.

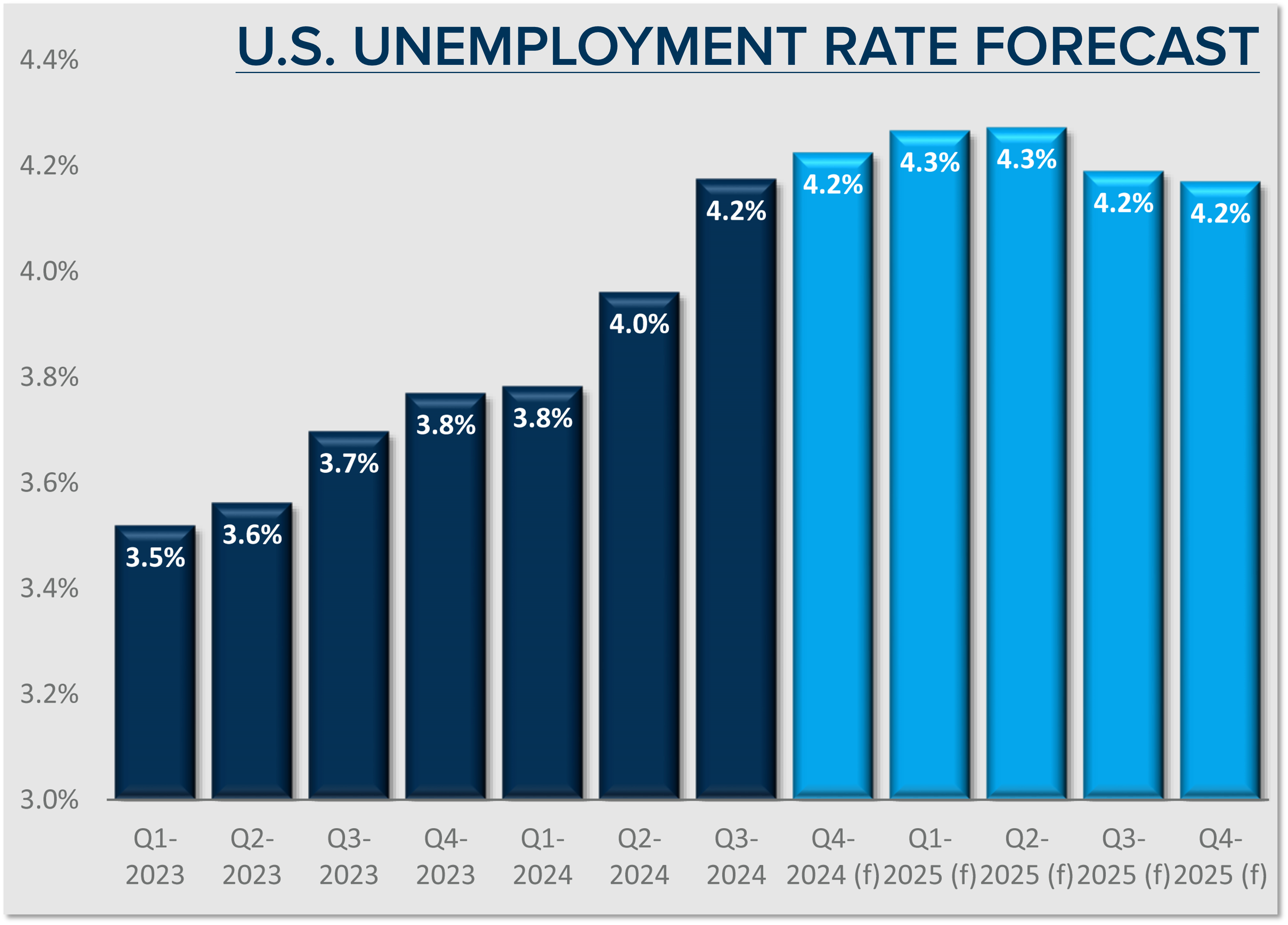

Tepid job growth in 2025. The labor market has cooled nationally after the “catch-up” period seen after the pandemic. Going forward, proposed immigration reform could weigh on labor force growth and hamper job creation. Weak labor force growth keeps the unemployment rate from rising in any meaningful way and is anticipated to peak around 4%.

✅ GREATER SEATTLE AREA JOB MARKET:

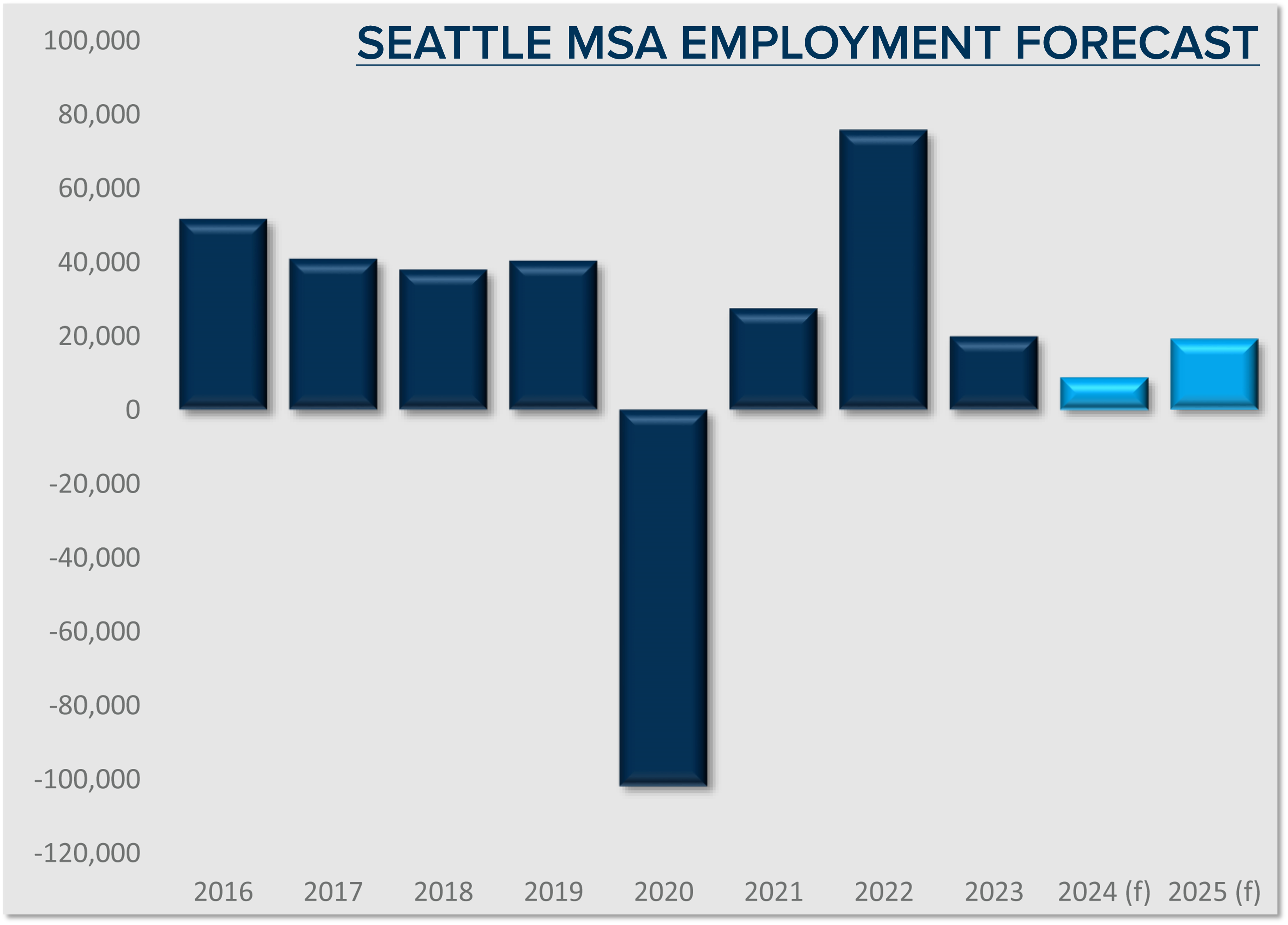

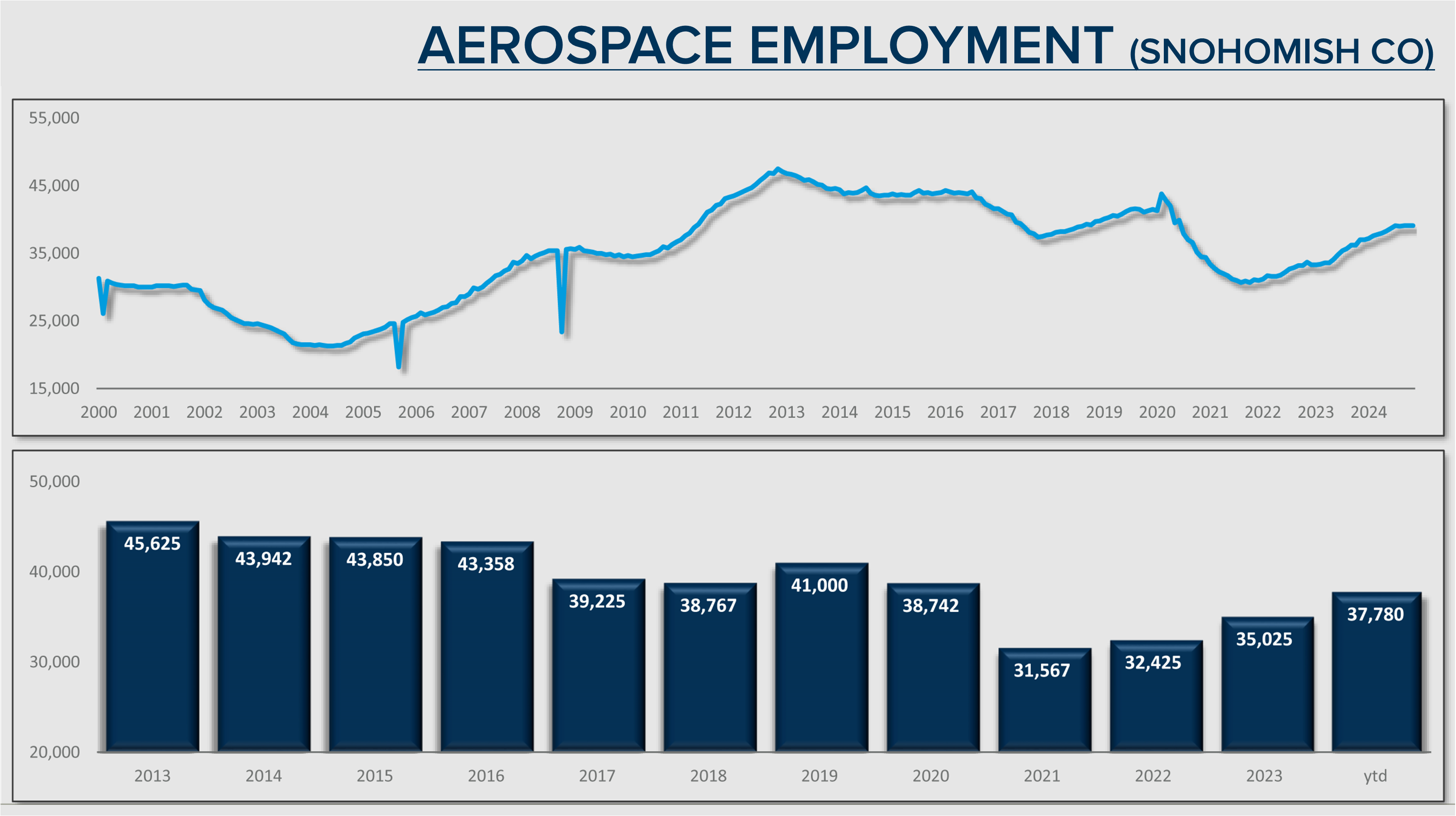

Job growth is still happening, yet ever so slightly! Jobs expanded by 1.2% in 2024 and should expand by 1.5% in 2025. The tech sector props up King County, and Snohomish County did have a relatively positive recovery post-Boeing strike. The construction sector is down, and some businesses will “wait and see” about growth once the administration starts to take shape with trade and immigration policies, which will directly affect labor costs.

✅ GREATER SEATTLE HOUSING MARKET:

Inventory will increase in 2025 over 2024 by 8-10%. In 2024, inventory increased by 14% over 2023, which saw the lowest levels since the Great Recession. Lower inventory has been driven by the “lock-in” effect created by the previous low interest rates. Moves have been less discretionary and more so motivated by death, divorce, and diapers. More discretionary moves will happen when homeowners see mortgage rates closer to within 2% of their current rate. However, equity levels are high (over 50% of homeowners have 50% or more equity), enabling buyers who are also sellers to reposition their equity to a home that better fits their lifestyle, should the monthly payment work for them.

Mortgage rates will modestly decrease throughout 2025 and should end up in the low 6%. The biggest headwind is deficit spending now that inflation has settled. This spending will keep the 10-year treasury high, which will have a direct impact on mortgage rates. These are two key factors to watch if you’re waiting for mortgage rates to drop significantly.

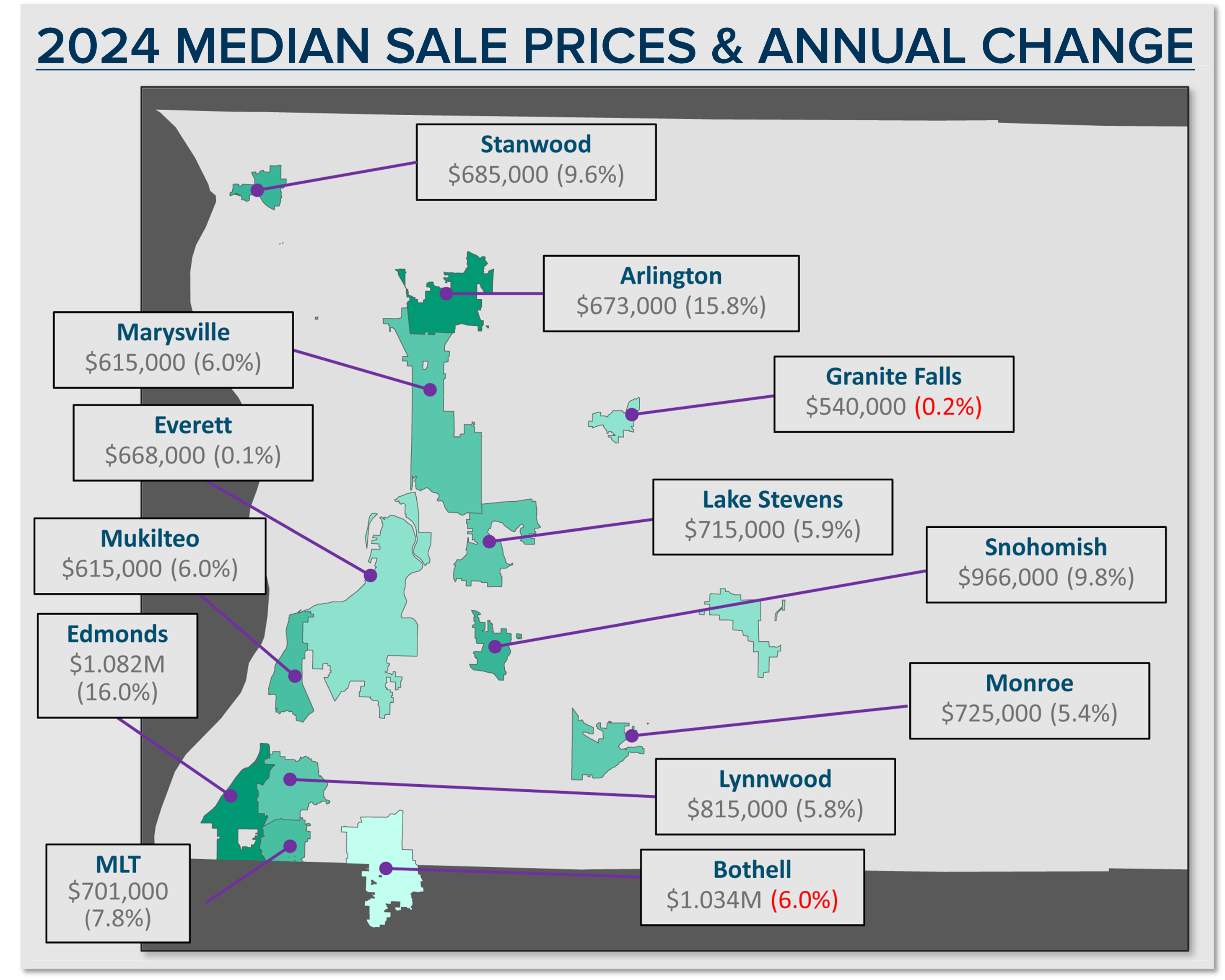

Prices increased in King and Snohomish counties in 2024 and are expected to grow again in 2025 despite stubborn mortgage rates. In King County, inventory was up by 10%, sales were up 12%, and the median price was up 10.7% year-over-year. Price growth is predicted to increase by 4% in 2025, which is higher than the historical national annual average. In Snohomish County, inventory was up by 17%, sales were up 8%, and the median price was up 9.9% year-over-year. Price growth is predicted to increase by 5% in 2025.

Affordability is the biggest challenge. With price growth steady coupled with higher interest rates, monthly payments have grown faster than incomes. This has put first-time homebuyers at a disadvantage in core job center locations. Down payment assistance (gift funds) from family and/or high-paying salaries in the tech, biotech, and big corporate companies have differentiated the ability of some first-time homebuyers compared to others with limited down payment funds and higher debt-to-income ratios.

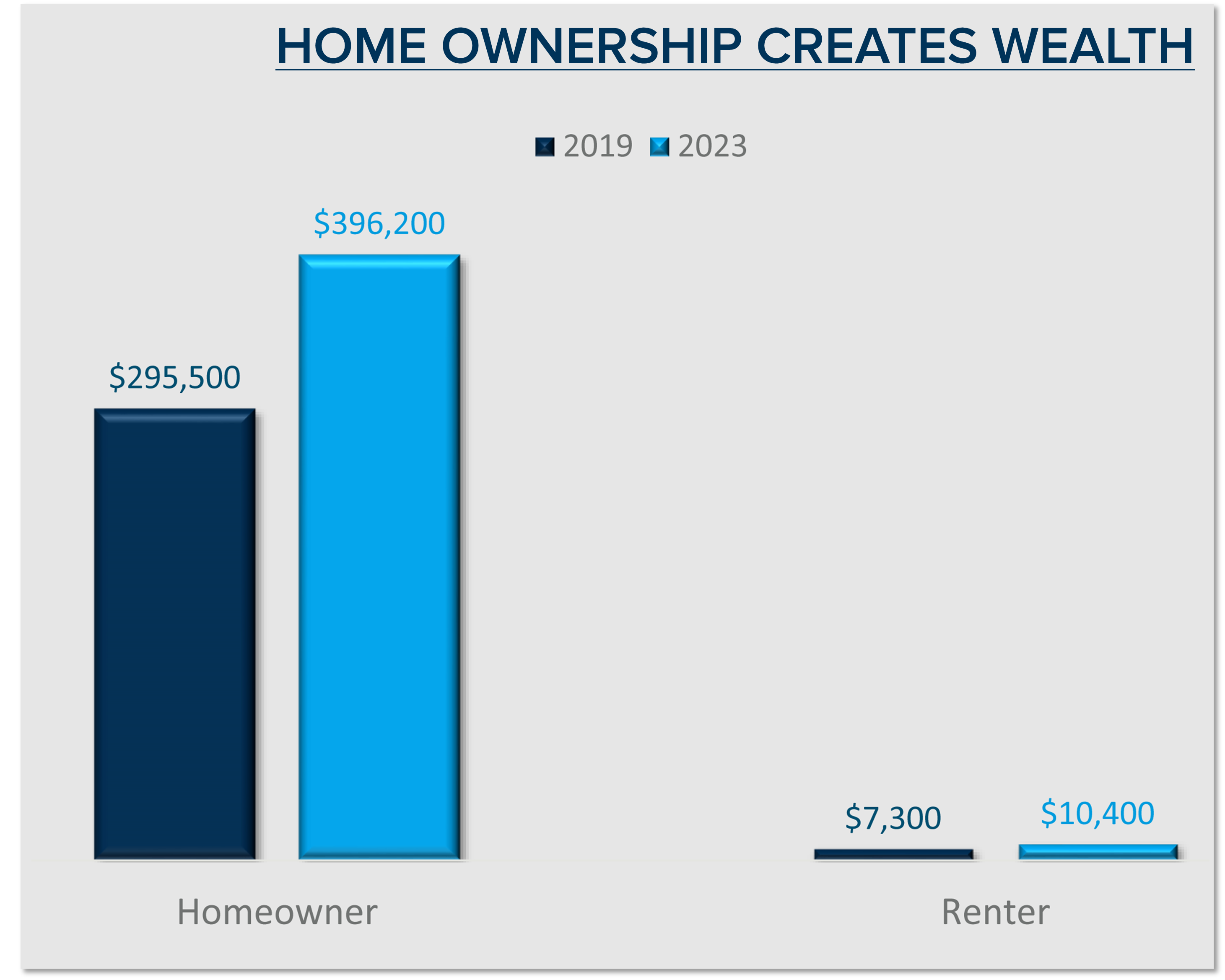

The American Dream is still alive! Homeownership has proven to be one of the strongest hedges against inflation and the single most lucrative wealth-building asset a household can have over time. A key piece of advice for first-time homebuyers would be to do what you can with what you have, which may mean buying a smaller property or going further out in location. Regardless of where one buys, this will put them on the trajectory of building household wealth through real estate and open up an opportunity to upgrade later. In fact, the net worth of a homeowner in 2023 was $396,200 vs. $10,400 of a renter.

This is certainly a lot to unpack as we head into 2025. Stay tuned for even more insights on what we learned from Matthew in my next newsletter. In the meantime, I am here to encourage you and point out that this is a lot of good news. We look forward to more moderate growth in 2025, which is good. Severe increases are not healthy. While we are combating an affordability crisis, the steady wave of moderation on top of incredibly high equity levels should play out to create a stable and fruitful 2025 real estate market.

If you are curious about how all of this relates to your real estate goals or you know someone that needs some guidance, please reach out. I will continue to help keep you well informed so you can be empowered to make strong decisions.

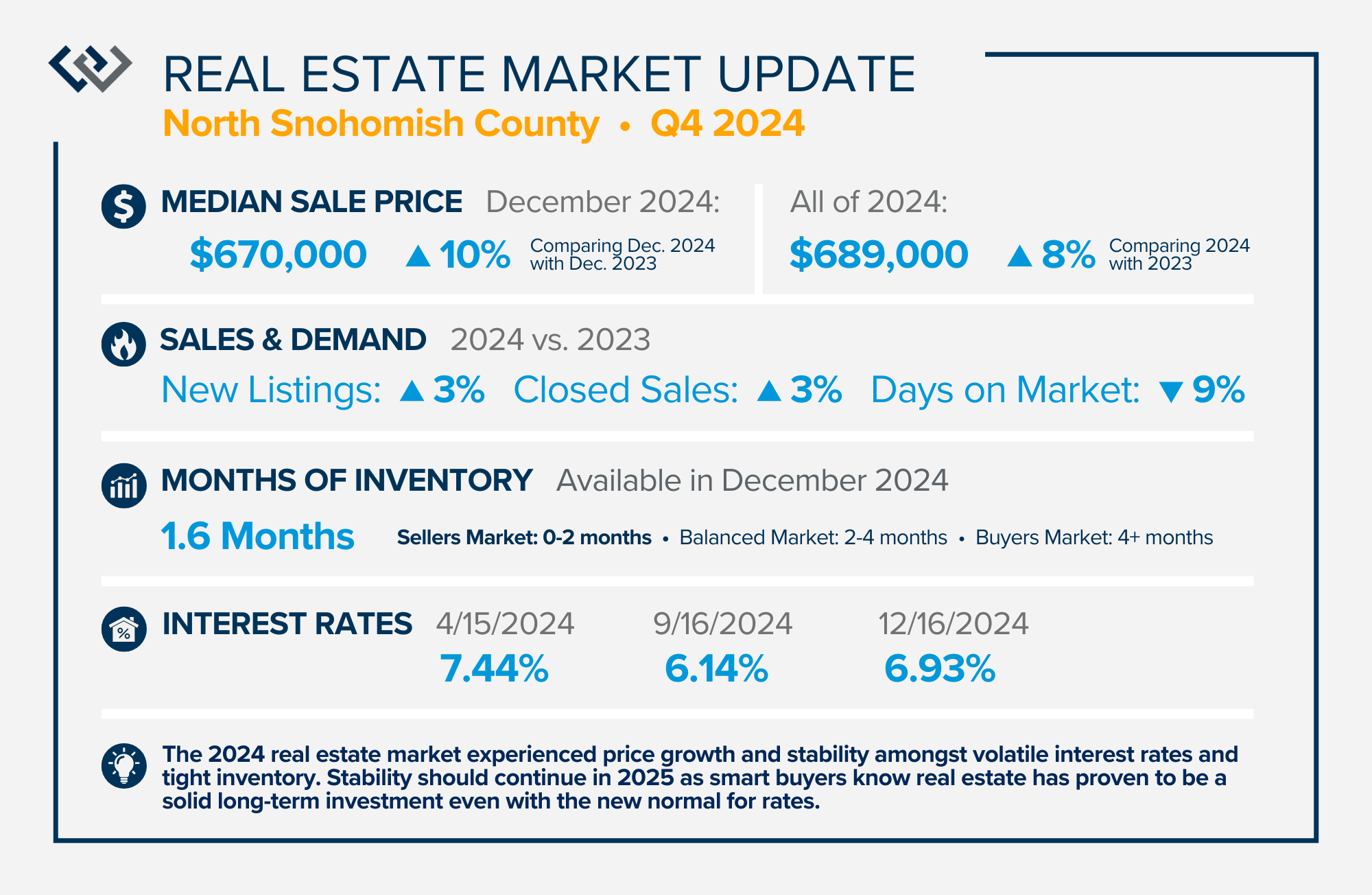

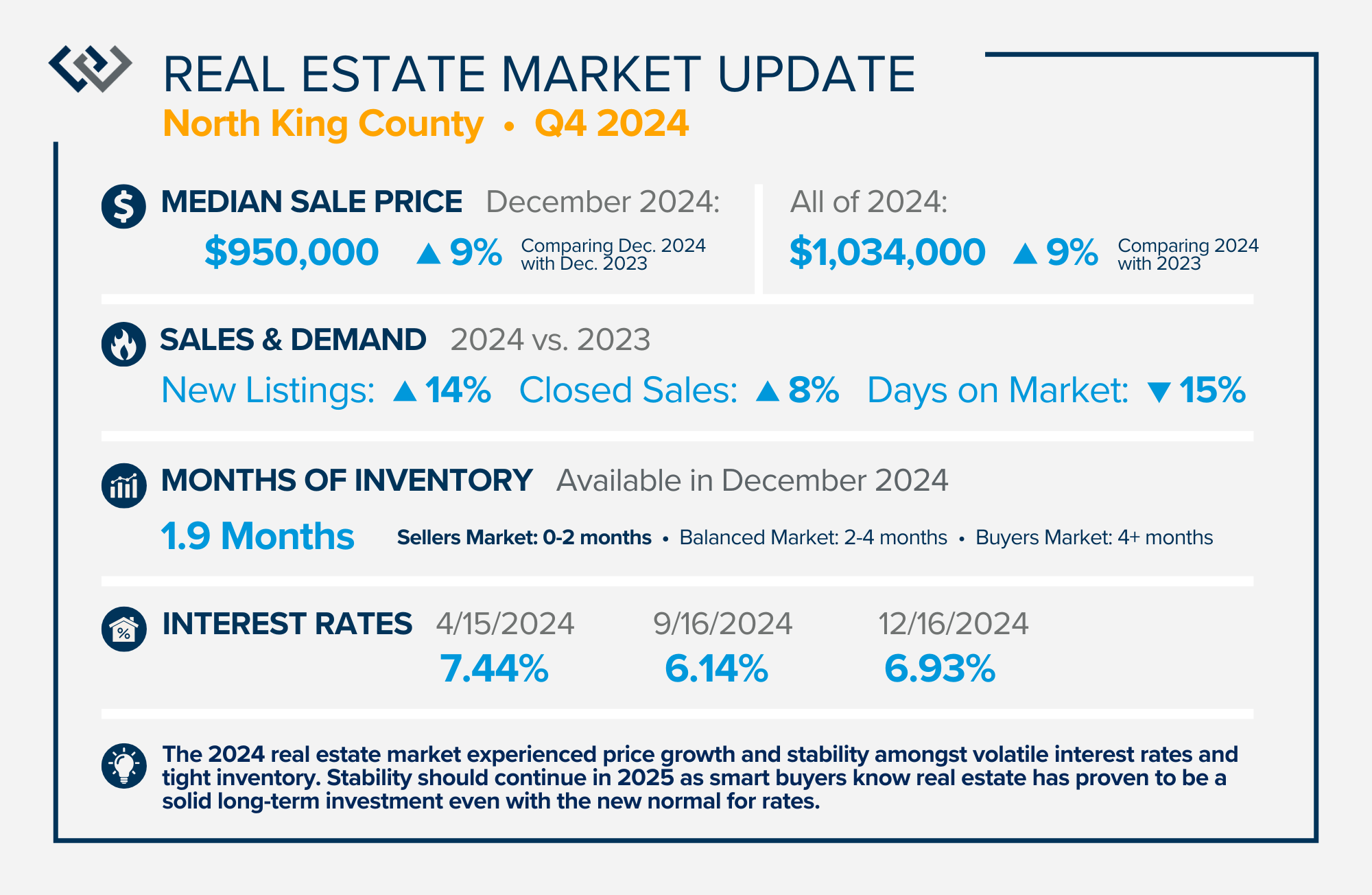

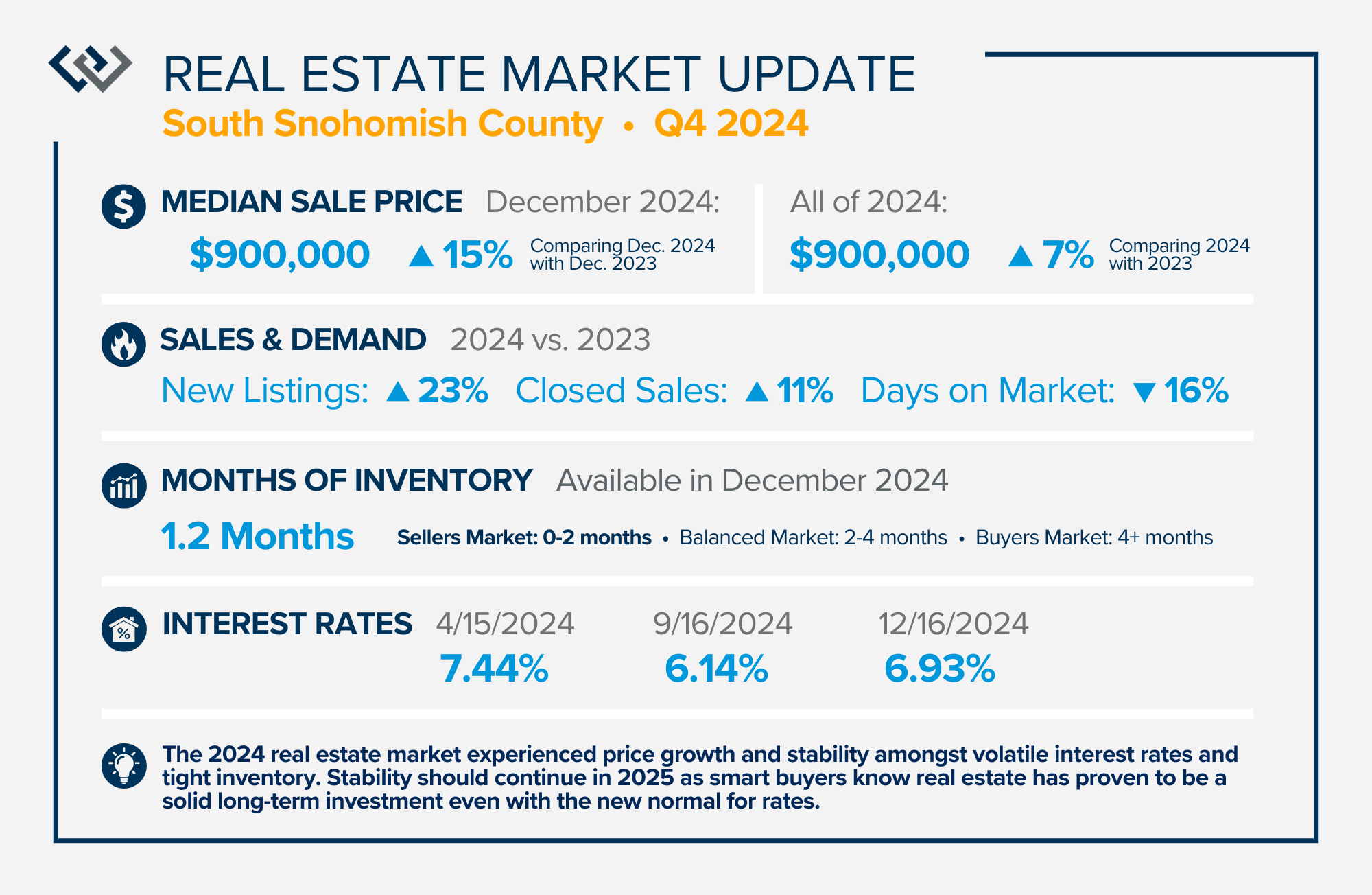

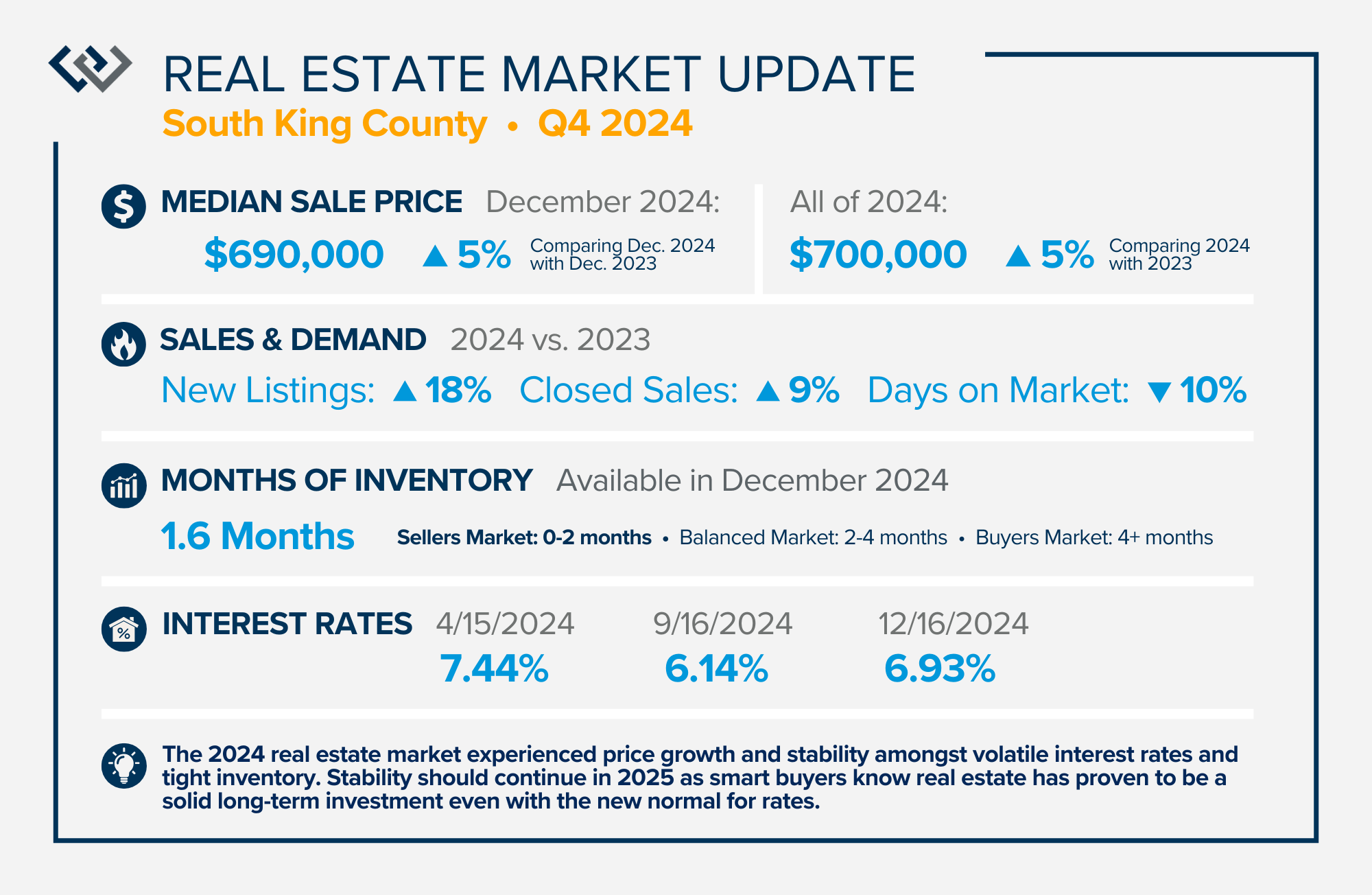

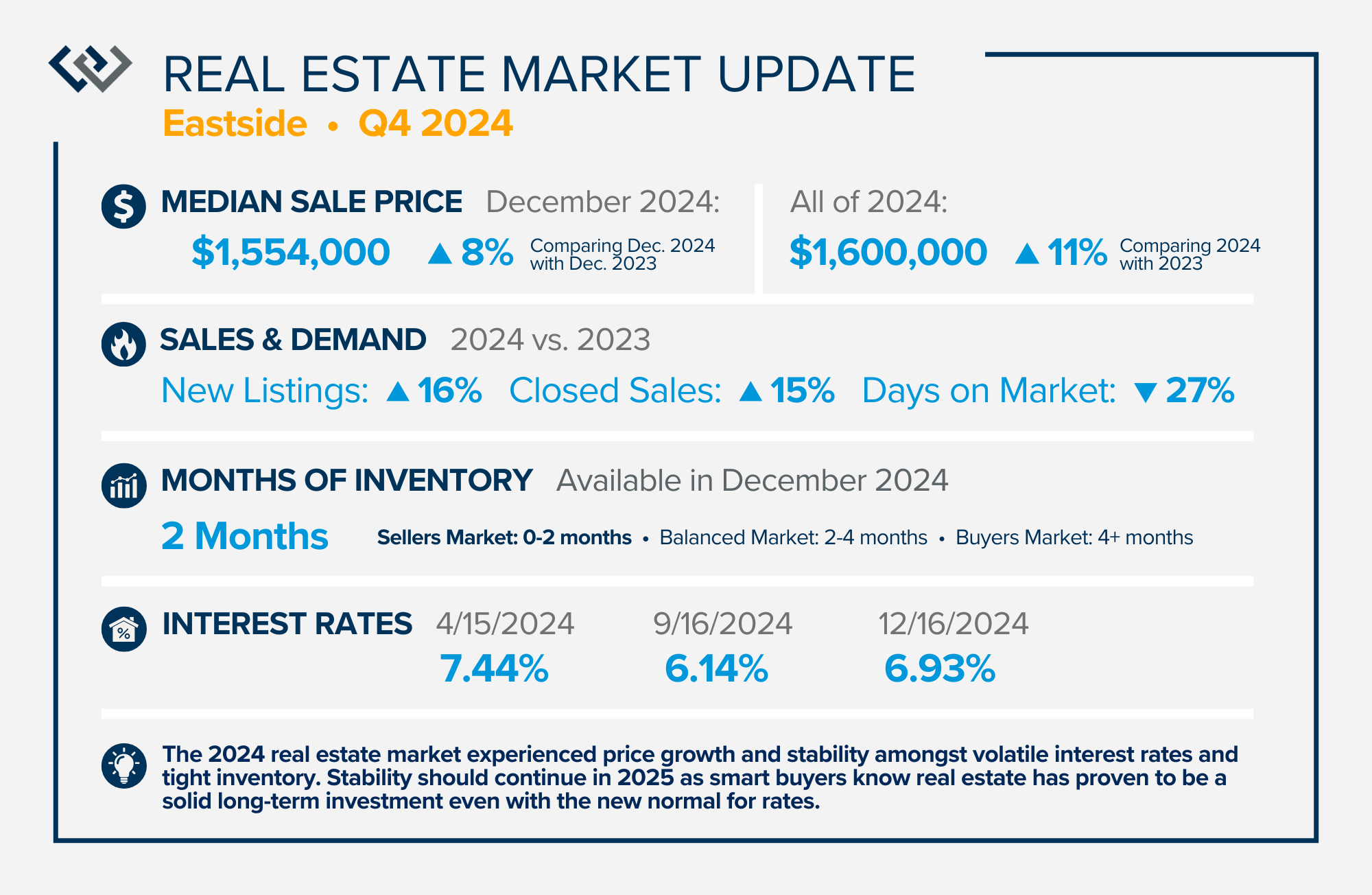

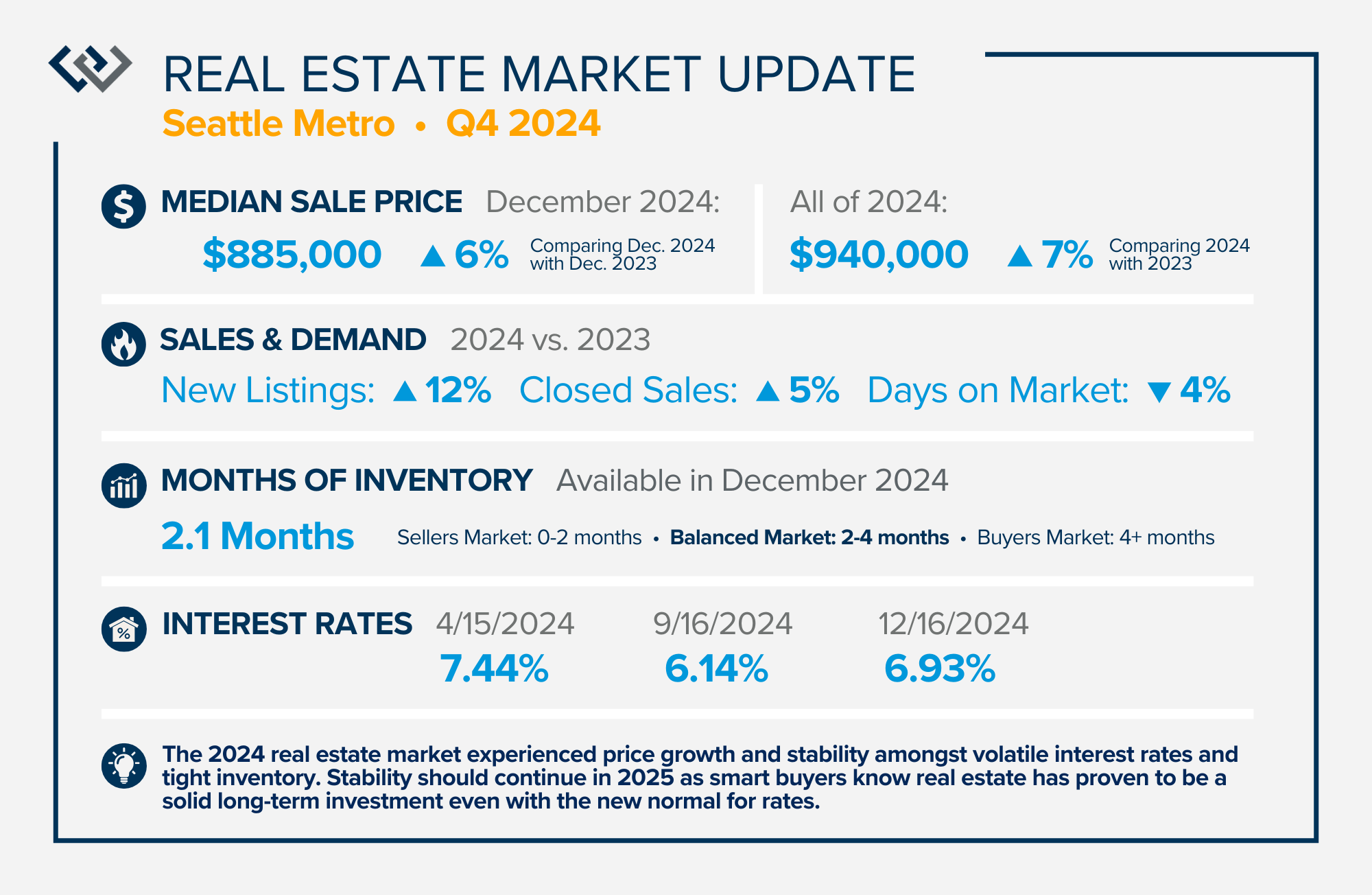

QUARTERLY REPORTS Q4 2024

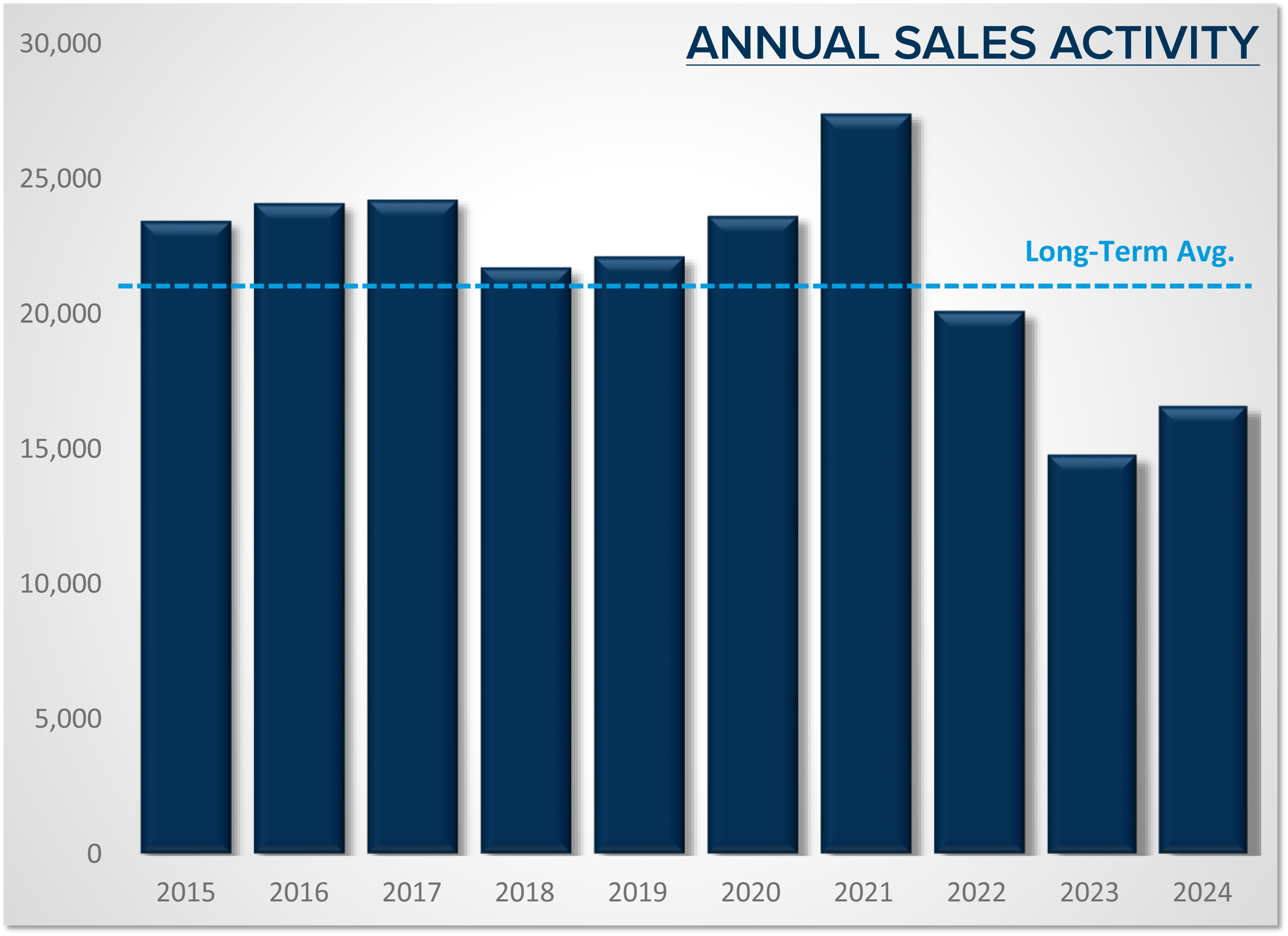

The 2024 real estate market experienced price growth and stability amongst volatile interest rates and tight inventory. There was a welcomed increase in closed sales in 2024 compared to 2023, which recorded the lowest level of closed sales since 2008.

Low inventory levels were driven by the “lock-in effect” from the previous lower interest rates. Price growth over the last decade has been abundantly strong despite a correction in 2018 and 2022. This has provided would-be home sellers the opportunity to reposition their equity and take on a higher rate. We are starting to see more sellers give up their lower rate to move to a home that better fits their lifestyle. This should continue in 2025 as smart buyers know real estate has proven to be a solid long-term investment even with the new normal for rates.

If you are curious about how the trends relate to your real estate goals, please reach out. It is my goal to help keep you well-informed, find opportunities, and empower strong decisions.

A December to Remember

Reflecting on the joy of the holiday season always brings with it gratitude. One of the most important pieces of my business is working with an office that always makes it a priority to come together as a team throughout the year to lift up our neighbors in need and give back to our communities. Our collective gratitude runs deep, and spreading some love and support within our community is the best way we can celebrate everything we are thankful for.

This year our holiday food drive brought in $1,372 and 1,422 pounds of food for Volunteers of America Western Washington food banks. These numbers are all thanks to friends and clients like you. Thank you for your generosity! The current need in our area is high, and our local food banks need all the help they can get.

Next, we had the absolute joy of helping bring some Christmas magic to homeless/housing-insecure youth in our area. We partnered again this year with Washington Kids in Transition, who work with social workers in Edmonds School District schools (includes the communities of Edmonds, Lynnwood, Brier & Mountlake Terrace) to collect wish lists from homeless/housing insecure students living in shelters, tents, cars, transitional housing or other temporary housing and partners with the community to fulfill those wishes. The brokers in my office all came together and we adopted the wish lists of 24 local youth, who would have otherwise gone without this holiday season.

The rest of the year, Washington Kids in Transition provides emergency closets (coats, diapers, toiletries, etc.), hotel vouchers, utility assistance, rental deposits, and recently started a teen mentorship program. This new program is in high demand, but does not yet have reliable funding, so we decided to also raise funds for that as well over the holiday. We raised a total of $3,815 for this new program, which helps teens learn basic life skills as well as have fun activities they otherwise wouldn’t have access to.

Another holiday staple at my office is putting together volunteer groups at Christmas House and also Holly House this year. Both organizations are local non-profits (100% volunteer-run) that provide opportunities for qualifying, low-income parents to select free holiday gifts for their children. This is always an amazing time helping families in need have a joyful Christmas.

You can access any of the links above to learn more about these organizations or to donate yourself. As we head into 2025, our commitment to giving back to the community that we serve will remain a cornerstone of our business. Here’s to a happy, healthy, and heartwarming 2025 and beyond.

Real Estate Year in Review: Looking back at 2024 to look forward to 2025.

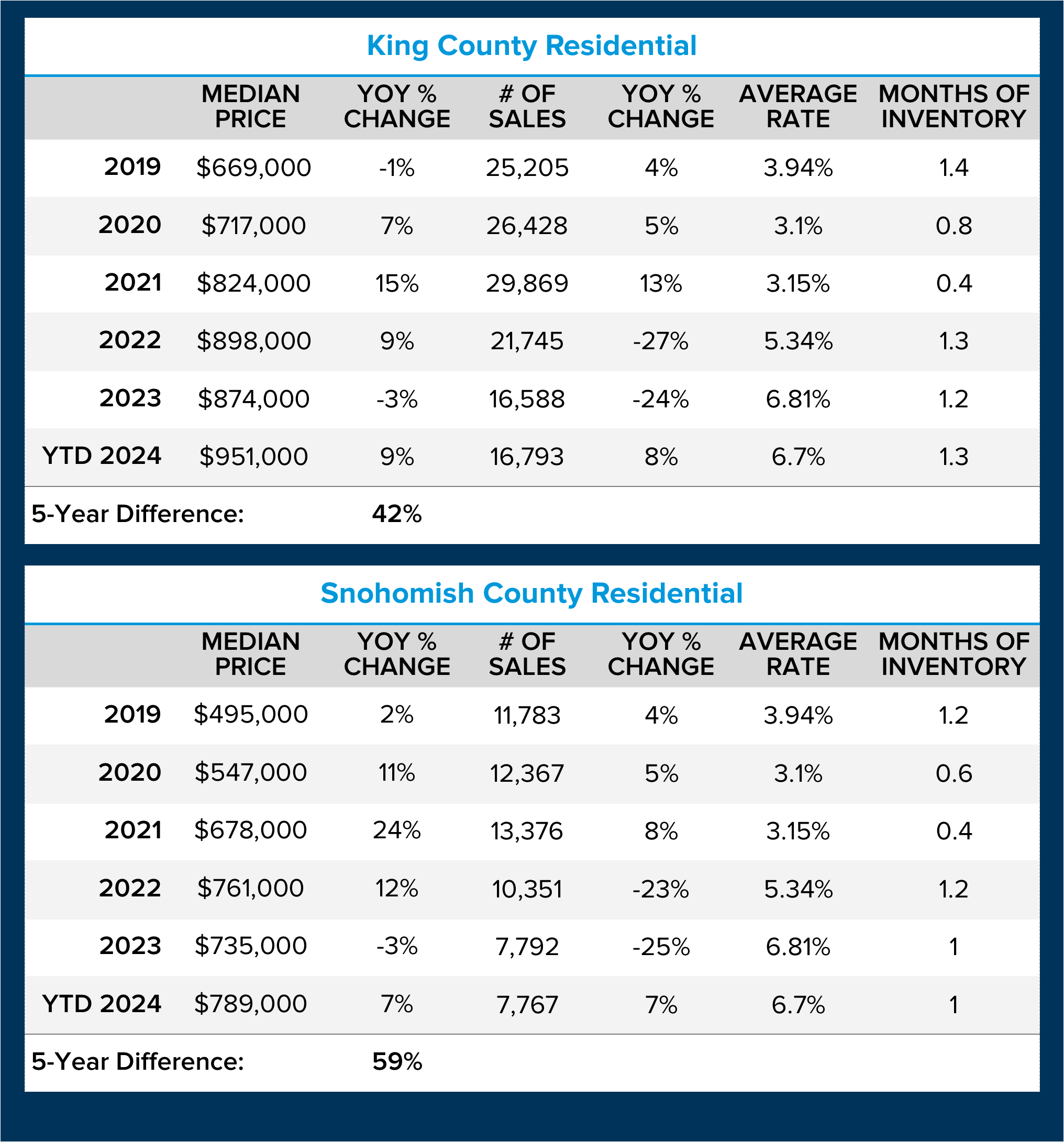

As we head into the holidays and mark the final stretch of the year, I wanted to report on the 2024 real estate market and where we might be headed in 2025. To set the stage, I must mention the ride that it has been over the last five years. Since 2019, we have experienced some key market factors that have influenced market activity and prices.

2019 was a year of recovery after the market corrected in 2018 (due to the Seattle Head Tax), and we all know what happened in 2020. The pandemic threw the real estate market into a frothy uptick from mid-2020 to mid-2022, fueled by work-from-home moves and historically low interest rates. Sales counts and price appreciation were ” off the charts,” specifically in 2021. Once interest rates climbed over 5% in the spring of 2022, price appreciation capped, started to correct, and sales declined. Since then, prices have recovered and stabilized, and the sales count has slowly started to increase.

After reviewing the last 10 years of closed sales, we are down about 25% YTD in King County and 30% in Snohomish County from a normal average closed sales rate. This has remained stubborn due to the lock-in effect that the previous low rates have created. For example, many homeowners who purchased or re-financed to obtain a rate of 3-4% are holding tight to their monthly payments. This has caused many people to stay in homes that don’t ideally fit their lifestyle due to wanting to keep the monthly payment and overall affordability.

This has created tight inventory, which has insulated prices and helped the market recover from the 2022 correction. The dance between rates and low inventory is directly related, and despite rates being higher in 2024 than they were in 2022, prices remain strong. A seller’s market is defined by 0-2 months of inventory (if no new homes came to market, we would sell out of homes in this amount of time), a balanced market is 2-4 months, and a buyer’s market is 4+ months. Over the last 5 years, we have primarily been in a seller’s market. This has caused prices to increase by 59% in Snohomish County over the last 5 years and by 42% in King County.

The age-old principle of supply and demand has had the most significant impact on prices despite volatile interest rates. Several experts predict that interest rates will slowly decrease throughout 2025. As you can see from the chart below, we will not return to the historic levels we saw in 2020-2021 (we may never). As would-be sellers contemplate the lock-in effect vs. what they want/need out of their housing and line it up against interest rates, we should see a gradual increase in closed sales in 2025 over 2024. The market is slowly starting to accept this new normal. Also, in some cases, moves cannot be delayed due to life circumstances, and the lock-in effect is not a driver.

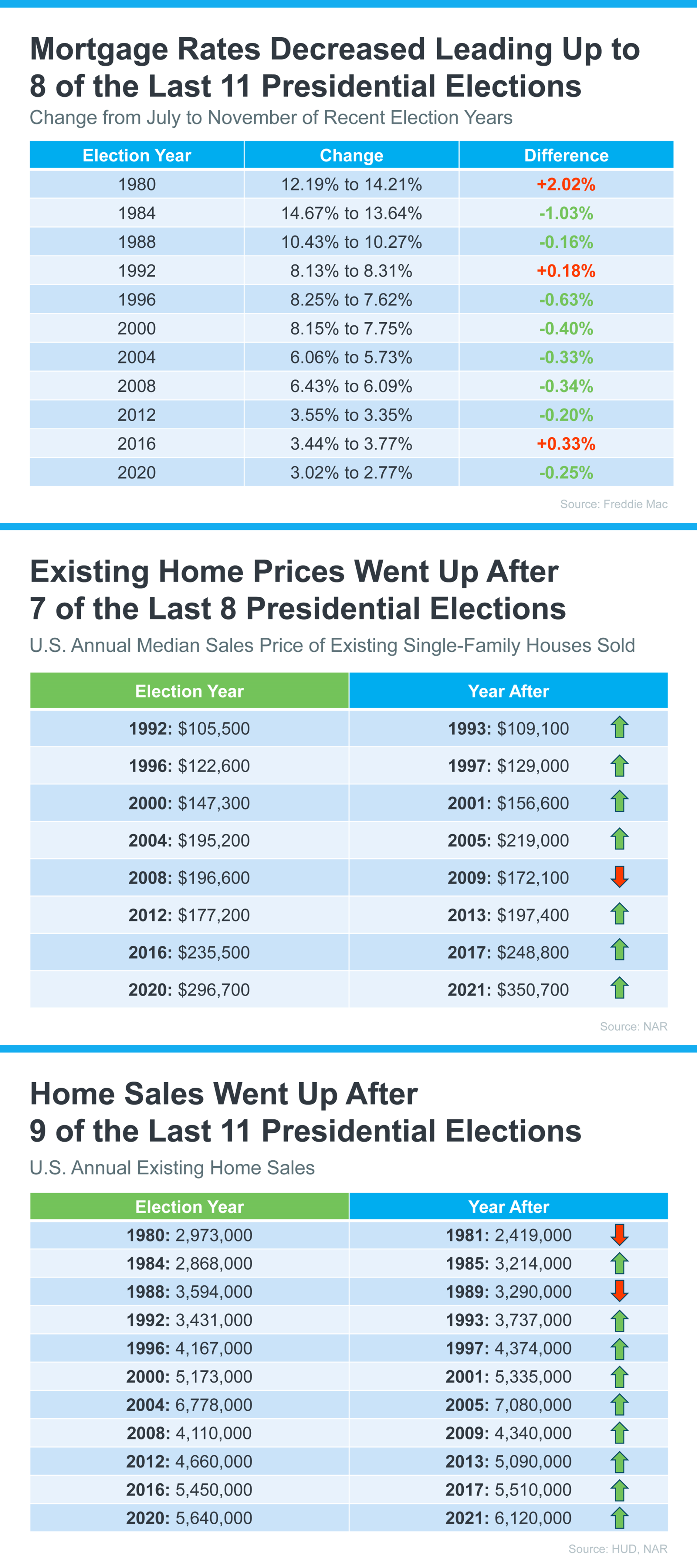

Another aspect to point out is the trends we typically see in post-election years. Historical data indicates increased closed sales, lower interest rates, and price growth. This data, coupled with pent-up seller demand and gradually decreasing interest rates, should drive sales to increase slightly and prices to appreciate and remain stable. Most homeowners are sitting on well-established equity, enabling them to make fluid moves.

If you or someone you know is considering buying, selling, or both, now is a great time to reach out. Executing a purchase and/or sale and a move takes strategic planning to achieve the best outcome. I love helping my clients identify their goals, curate a detailed list of items to create the ideal results, and help guide the process to a successful finish. A new year brings a fresh start, and why not start to verbalize, visualize, and start your planning now, whether your goals are immediate or in the distant future? Please use me as your real estate resource, as my goal is to be your trusted advisor rooted in data and market education.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link